Few people understand the concept of trading system expectancy. Knowing this concept is the closest thing to a "Holy Grail" one can find in trading.

No Holy Grail, Only Holy Grail Syndrome

Several months ago I did a write up about "Holy Grail" syndrome (where people chase gurus or systems and never seem to find the right one).

My thesis at the time was - there is no "Holy Grail" so it's better to eventually find one style and stick to it! I took for granted that some people don't actually have trading systems or understand the closest thing to the "Holy Grail" - system expectancy.

There is another write up on building a winning system which lays out the ingredients needed to find expectancy. If you aren't familiar with it's components, perhaps a good starting point.

So what is Expectancy?

In it's most rudimentary form, expectancy is what we expect (duh) our trading system to produce given we follow our trading rules. It is determined by some key ingredients:

- Position Size - how much we risk per trade

- Win/loss ratio (X% wins and X% losses)

- Risk/Reward ration (for every 1 Risk, I anticipate X Reward on average in Return)

- Amount of trading opportunities produced by your entry and exit criteria. This depends on the rules your system define to get in and out of a stock.

We then bake these ingredients together and can extrapolate what we... expect our system to produce in X amount of trades. It's actually that simple!

Example

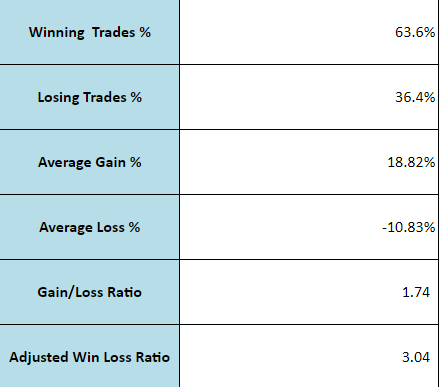

From my own trading statistics if I take my current trading numbers:

So very simply, to calculate this for yourself:

(Winning Trades % x Average Gain %)/(Losing Trades% x Average Loss) - 1

This means that on average, every time I risk $1 I anticipate getting $3.04 over say 100 trades. To clarify my "Adjusted Win Loss Ratio" would be my system expectancy from the above journal.

I've tracked my expectancy over 6 years and seen it fluctuate with certain market conditions too so I try to be very brutally honest with the results. If you plug in numbers to massage your ego, you the actual results will probably knock it down a peg.

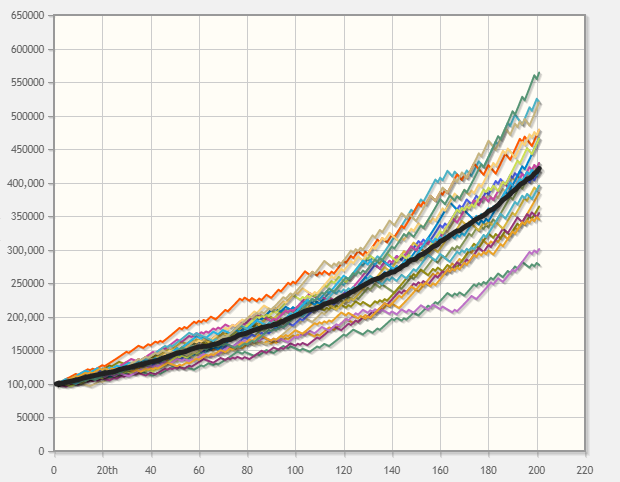

So if I look at this system and had say $100k, and on average 200 trades each year, and took 1% Portfolio risk per trade, it would look something like this:

This lines up pretty well with my stock trading objective which is triple-digit gains. Of course this won't happen every year! The point is to give you confidence in your system and understand it's up and downsides.

Even though 1% risk doesn't sound like much, if you get a string of losing trades and are down 20% from the "high water mark", trading can become a real emotional battle.

Be Realistic with Your Trading System

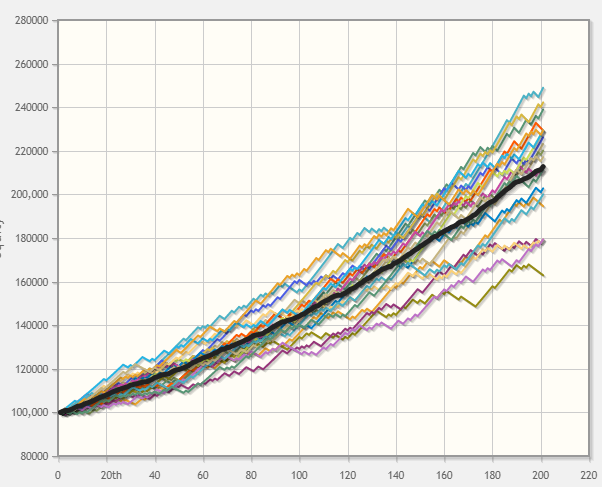

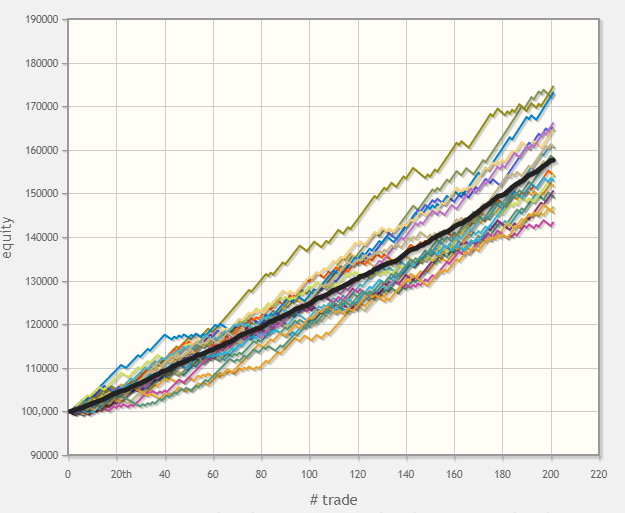

Realistically I seldom put on 1% risk per trade. I am very risk averse and sometimes tip-toe into the market to avoid getting nuked. So to reduce my dependence on Tums (for the Americans) or Rennies (for my Europe bros) I can go as small as 0.5% risk per trade or even 0.3% when the market is dumping:

Scaling up risk helps reduce downside emotions but still be "in the game" if the market turns around. Far too many traders focus on the upside in these charts but totally underestimate the stress caused by trading.

I've found my smallest positions at 0.3% work out well to reduce stress, when things work I can scale in. When needed I kick in to 0.5% and then 1%. After this point I trail stops and either step on the gas or take profit. This is where we move from theory to art. 10 Traders can get the same trade setup and half will lose money.

The Newsletter

Sign up to get a monthly email about my trading journey, what I learnt or failed to learn and receive exclusive access to unpublished material and resources.

How to Develop a Data-Driven System

The best way to test your current trading out is to use a trading journal. Of course the major prerequisite is having a working trading system where you can define your entry and exit points.

If you are at the point where you don't even have a system, I suggest starting here. These are the ingredients you will need to bake your data cake.

The general rule is that 100 trades will give you a overall gauge of your trading numbers. Before the accountants jump in on this arbitrary number, it doesn't factor in market conditions or any special indicators. I like to aggregate 100 trades from my best and worst years to give me a realistic view of what to expect.

Don't Cheat

Turning a blind eye to bad trades is a big disservice to yourself. Make sure to put in the ugly ones too. There is no point setting up false expectancy numbers as they probably are much closer to reality (because they did ACTUALLY happen) than you think.

Experimentation

The nice thing about system expectancy and using a journal is you can experiment with the numbers and create simulations using a monte carlo simulator. This has helped me find small errors in my trading such as:

- Over-trading

- Too small position size on winners

- Large positions on losers

- Trading junky stocks

It's quite amazing to see how your system expectancy increases when you remove these bad trades and see the truth about trading. For me, it really reinforced the fact my system works and removed the fear response when moves went against me.

Another thing you can do is change the position size in your trading journal to experiment with position size. This is a pretty interesting one mess with. In theory you can have a system with relatively high success which could make you billions - the problem being you may have to stomach a 80% draw down.

It's all relative. If it's not realistic then there is no point!

We've also recently started a Telegram where I post my trades once they close. If you have interest in seeing the entry and exit points it may help you define your own!