My early trading days were great. I was out of college in 2009 and just had my first paycheck as an engineer in J&J (Janssen).

I had been planning to save, buy a house and start loading up on all of the broken banks post 2008. Bank of Ireland, Allied Irish Bank and my all time favorite - the Bank of Greece. They were so low that nothing could go wrong! (I miss being this young and spirited). I was ready to sink each and every paycheck into the most broken companies I could find, specifically European banks.

I began buying bank stocks and many of them started turning up and working out, almost instantly. I was delighted and made my first mistake, thinking that "trading is easy". Bank of Ireland was up multiples of what I put in and I was right on the money (pun intended).

Subsequent to my buy point (right at the bottom where you see the blue arrow) Euro banks have never recovered.

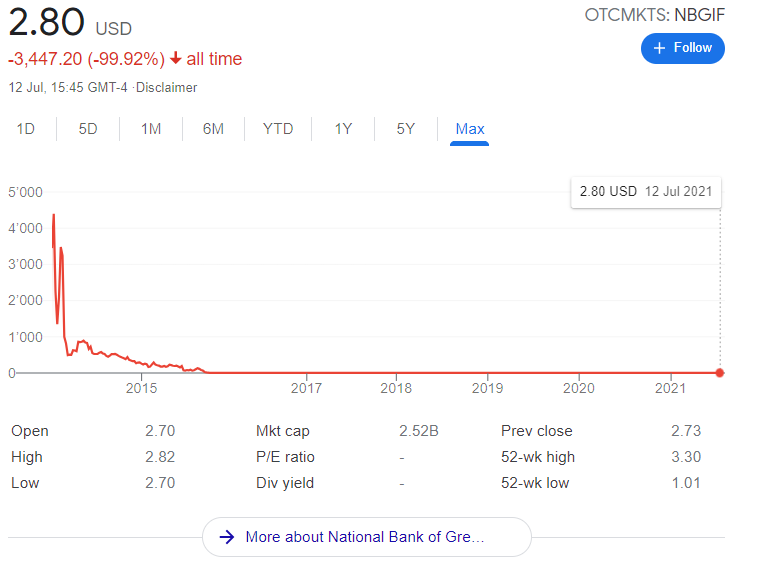

My next stock purchase was the fantastic Bank of Greece. "I will take my €6000 gains and turn it into at least €24k", I thought to myself. At this point, I was scouring the internet and on Stocktwits (garbage) actively pursuing my biases - we were all going to be rich! And rich we became. Rich in experience of just how the stock market can completely ruin you financially if you don't know what you are doing:

The beautiful Bank of Greece helped me part ways with over 90% of my investment, this is when full Type 1 thinking kicked in and I lied to myself about why it's "okay to lose money" or "it will come back, it has to". I began what is almost all new or losing traders initial spiral into losses that are hard to exit. The process of rationalization and justification. I kept asking myself questions like:

- How can it keep falling, its already so low? (Incorrect assumptions)

- Bank of Ireland did so well, this is the same EU turnaround story! (Recency bias)

- It will come back tomorrow! (Denial)

- I haven't lost because I haven't sold, it will come back. (Ego protection)

- Ooooh! Look a buying opportunity. I hope it goes even lower.

- Okay it's gone lower. I can average down.

- I never wanted to trade this I wanted an investment for the long term.

- I believe in the EU (boy was I young and naive)

An Introduction to Biases and Trading Psychology

In a nutshell, I was experiencing what is called - the disposition effect compounded by ego and other unconscious incompetence. This effects our psychology by making us hold on to losing stocks or assets (even if they are wrong) or have an emotional attachment to things for a few reasons:

- Ego and being "right"

- The pain of taking a loss

- Hope and greed

- Seeking of external validation.

We take winning trades off the table and get small profits whilst bleeding out somewhere else.

When I was younger, all I would do is search the internet for a story to suit my narrative and take away the pain of loss. Ironically, that pain association with loss was the issue in of itself. Losses are a part of expected gain in the stock market if you know your trading numbers and edge.

The problem is, few stock traders or closet case gamblers look this deep when they trade. The end result is a lack of accountability and projecting blame into the market. The market is not to blame, we decide to buy or sell, there is no proverbial "gun" to our head. The stock market does not care about the disposition effect. Personalizing loss in stock trading and any other performance art makes it very hard to bounce back emotionally. Bouncing back is one of the key traits required to last in stock trading.

The Newsletter

Sign up to get a monthly email about my trading journey, what I learnt or failed to learn and receive exclusive access to unpublished material and resources.

Learning from Stock Market Losses

My own development has led me to believe the following about all of my stock positions and develop plans around trading to eliminate this effect. My following rules are:

- I can't let my stocks run past a pre-determined stop loss. That stop loss can't be more than 10% of any purchase price and ideally should be less than 6%. I never break this rule anymore. A classic O'Neill rule.

- It's all about probability. There is no right or wrong, only a statistical distribution that will play out in my favor over time. The only way to win is to have a system that works and trade it.

- I have no control over the outcome other than where to take a profit or where to set a stop loss. These points will be what makes me a champion trader.

- I would rather learn how to trade and learn a discipline than get lucky and not be able to replicate it. I want a skill, not a lottery ticket.

- The power is in the process. The money is secondary.

- Never EVER throw money into a losing stock. That is loser behavior. You do not want to become an "involuntary investor".

As said by one of the investing legends, Paul Tudor Jones:

To summarize why we hold losers:

- Our primitive defense mechanism is controlling our behavior, we are out of control and emotional.

- We are trading outside of our plan or not following it, even worse, we have not quantified and understood our trading system or it's expectancy.

- Our mind is framing stop losses as being wrong instead of the "cost of doing business".

- Our ego is blinding us to the objective situation by trying to "protect" us. If you are scared to open your account and know there is a losing trade in here, that should be saying something to you.

Holding losers does what it says on the tin - leads to more loses and we then feel out of control.... In trading as in life if you want to rewire your personal success and overcome heuristic or dogmatic thinking, you need to be brutally honest with yourself and cut losses early. My own method of cutting losses has become more refined over time.

I see losses as a function of expected gain based on my trading plan and deep understanding of risk. Framing things in these terms changed the association for me and I am sure can do it for you.

Find Out for Yourself

If you've struggled with losing money in trading stocks or cryptocurrency my suggestions are as follows:

- Find out how to back test your trading system here quantitatively (we have a free mini course on this here)

- Test your own results if you did cut losses early vs your current results using a trading journal (another free mini-course here)

- Burn into your conscious mind the difference this could have on your results

- Reduce position size and trade the system in real time

- Log your trades and review them routinely

Having read over 200 books on trading systems one axiom almost always stands out - cut your losses! Screamed from the rooftops practically. What I find funnier still is that if I had been able to execute on that cliche I would have been a far wealthier man those following years.

Sometimes old adages hold weight, this one certainly does.

Remember to cut your losses before they cut into your psychology. Trade to protect your psyche and focus on the process. The process and the art is where the big money is hiding.