Have you ever had the perfect chart pattern, done the analysis on a really great looking stock or crypto setup and somehow managed to not take the trade? Even worse, you take the trade, and on the first down tick you sell out only to watch it rocket in the coming days?

Worse still, somehow, you aren't sure why, the only stocks you do own are gapping down or not moving, these were stocks you probably didn't even have on your watch-list but somehow make up half of your portfolio!

Trading can show little mercy at the best of times but when the mistakes we make are ours to own, it can really mess up our confidence but stumbling over our own feet.

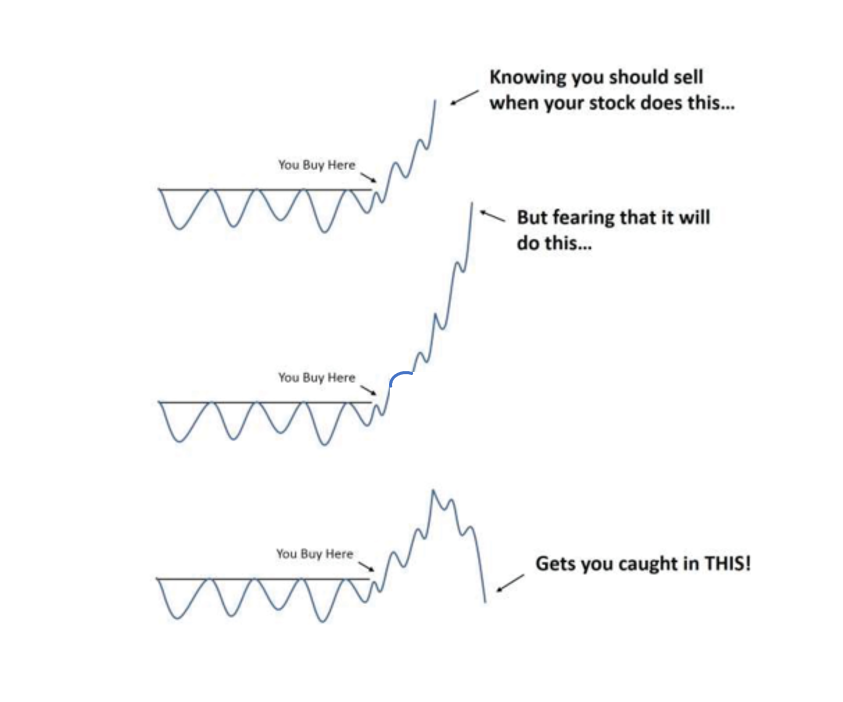

A small example below annexed from Mark Minervini:

Most, if not all of these trading issues all boil down to a few key issues for early investors and professional traders alike:

- We don't have a strategy at all (if you aren't sure, read this)

- We don't actually trade our strategy (if you want more information on what a strategy is, read here)

- We are not position sizing correctly

- We lack confidence or only focus on the negatives

- Our self-image is compromised

- We are picking and mixing strategies

People are dependent on the internet or some or other trading service to get answers but don't trust themselves enough to find the root cause of their inconsistent trading results. Many people know how to trade but get caught up in the outcome instead of the process.

It's easy to get immersed into a negative and self-destructive trading rut but turning it into a learning and fun process is what will keep you in the game.

The unrelenting truth is, you probably know what is wrong but aren't doing anything to actually change it!

Change is Scientific and Involves Reflection

If you think I am bullshitting you and feel "This guy is full of hot air, trading is just really hard", I really challenge you to do a simple task (or a few tasks). Commit to a trading journal of your last 100 trades and then find out the following:

- What % of trades should you have taken

- Of the trades you took, what quality were the setups (really)

- Now that you've realized you trade correctly less than 60% of the time, how do you feel?

If you don't know what a journal is or who to use it, there is a great YouTube course on it here.

The reason it's easy for me to make assumption number 3 is because that was me! And I know it's the vast majority of others because I have coached people who only traded 20% of their own planned trades. It was mainly down to a lack of belief, self-esteem and general fear.

The single biggest thing people need to do in order to trade well, is believe in themselves, be okay with losing and learn how to think like a winner. Without an unrelenting belief that you can master the stock market, you will risk second guessing everything you do .That uncertainty and doubt is toxic, it needs to be dumped.

Dump losing beliefs like losing trades.

If you still need convincing me, let me re-frame this in other ways. Please ponder the "why" below:

- Why is it so hard to get built like a god and follow a diet?

- Why do we know we should study but decide to do literally anything but study?

- Is there a reason we finish work and jump to Netflix instead of reading a good book?

Trading, dieting, being a good human being and achieving anything simply boils down to a bunch of habits. Habits, automated responses and all of the other cerebral activity has unfortunately been hijacked by tits on Instagram so people would rather toss the salad than do a trading journal.

I can almost guarantee that 90% of people who read and agree with this message will nod their head, truly believe that it makes sense and still never do a trading journal. They will assume they know what to change and then go back to making the same mistakes until they die, it's not mean, it's just how our brain works, unless we redirect it in other ways.

Okay, You Have a Point, How do I Change?

In this blog I've touched on creating new neurological paths in your brain that will help avoid self-sabotage. If you genuinely want to move to the next level then I would like to spell out for you a clear set of starting points that have really helped me overcome sticking a stick in my own spokes.

Some foundational tips to get your trading back on track:

- Stop following other traders into trades, only take trades as part of your plan

- Do that damn trading journal!

- Take that journal and see how well you would do it you followed your plan 100%

- Make sure your trading plan is written down, if you don't have a trading plan then make one

- Commit to trading your strategy for the next 50 trades

- Measure again

It Doesn't Need to be Complex

To iterate the point of this post, we decide every time we put on a trade to risk money in the hopes of making a profit or avoiding a large loss. More than likely, the trades that hurt us the most involve:

- Holding losing stocks

- Being overly bullish

- Having too many trades on at once

- Having too little or too much money on at once

- Trading someone else's plan

If you went to the gym and only worked out your chest and never developed other parts of your body, there would be an imbalance that is obvious to all! The very same when people overeat, hide it and tell all of their friends they have no idea why they are fat.

Trading is an absolute performance art, you are both the coach, player, judge, crowd and clean up crew. The trading team is a one man show in most cases.

Without measuring your performance, writing things down, practicing patience and developing discipline, your trading career will be down to pure luck and nothing else. I for one prefer the harsh truth of reality, reality is where the money is. It's harsh but highly rewarding.

If you read this, know what you have to do and still don't do it, there is nobody to blame other than the head trader of your personal fund..... you! Get that journal out, adopt a positive approach and get in sync with your trading plan.

Hoping you enjoyed this one, make sure to join our telegram and see you in the chat!

The Newsletter

Sign up to get a monthly email about my trading journey, what I learnt or failed to learn and receive exclusive access to unpublished material and resources.