Very seldom do we get insights into how super performance traders pick stocks and manage risk. In fact, many trading chat rooms and or services are slow to share their results (I wonder why?).

Fortunately, the living legend that is Mark Minervini, was generous enough to publish his audited results when he won the United States Investing Championship in 2021. He even published the audit which can be found here .

I ran through some of his trades and looked back on the entry points and stop losses. The goal: to really drill into the main difference between his buy points and my own. Why?

- During the 2021 period I noticed we picked the same stocks or we had similar stocks on deck

- For some reason I bought other stocks because I didn't trust the "obviousness" of the setups

- 2022 Has been harsh on my account and I need to slow down and analyze my behaviour

- I want to integrate Mark's performance into some leading indicators for myself about process, setup quality and other metrics

The Trades

Below is an excerpt from his audited results that includes entry point dates of his buy points:

Just to use a few examples, I did some quick charting to see what these buy points looked like in real time:

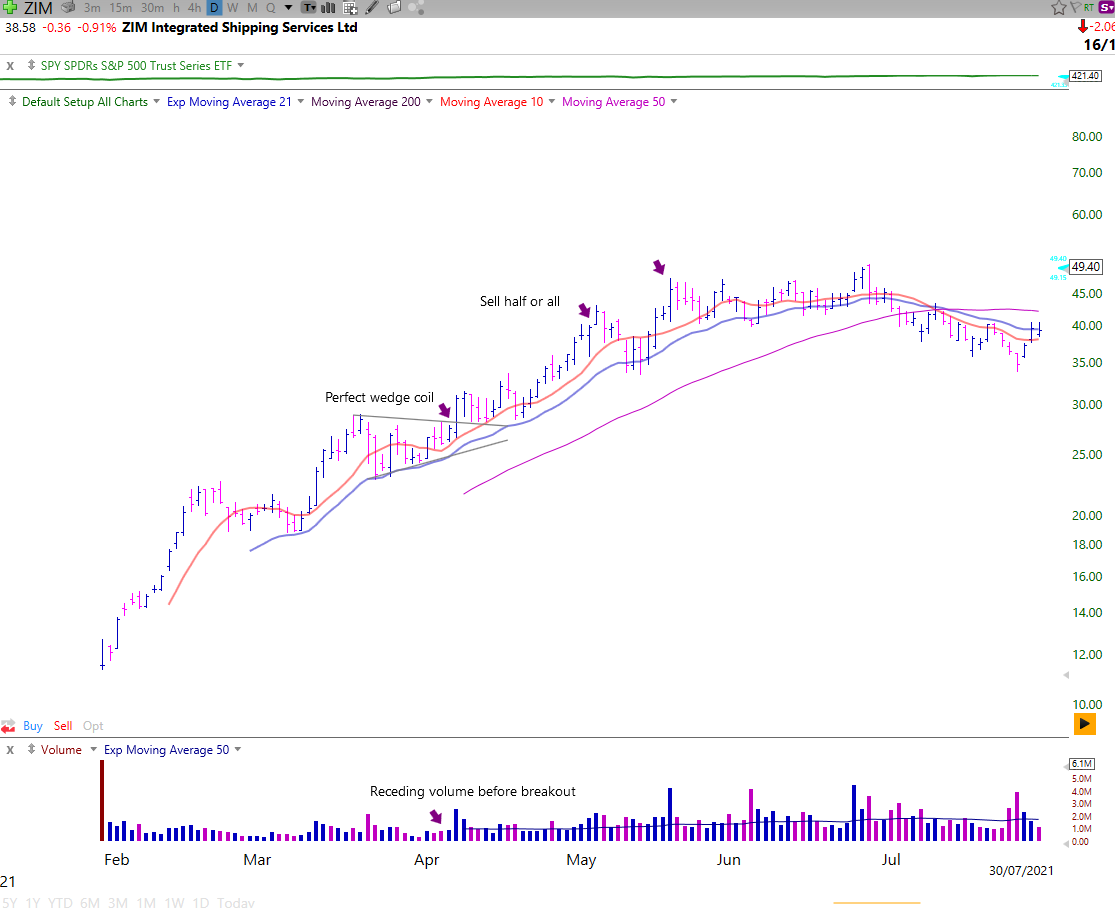

ZIM - APR 08, 2021 Trade

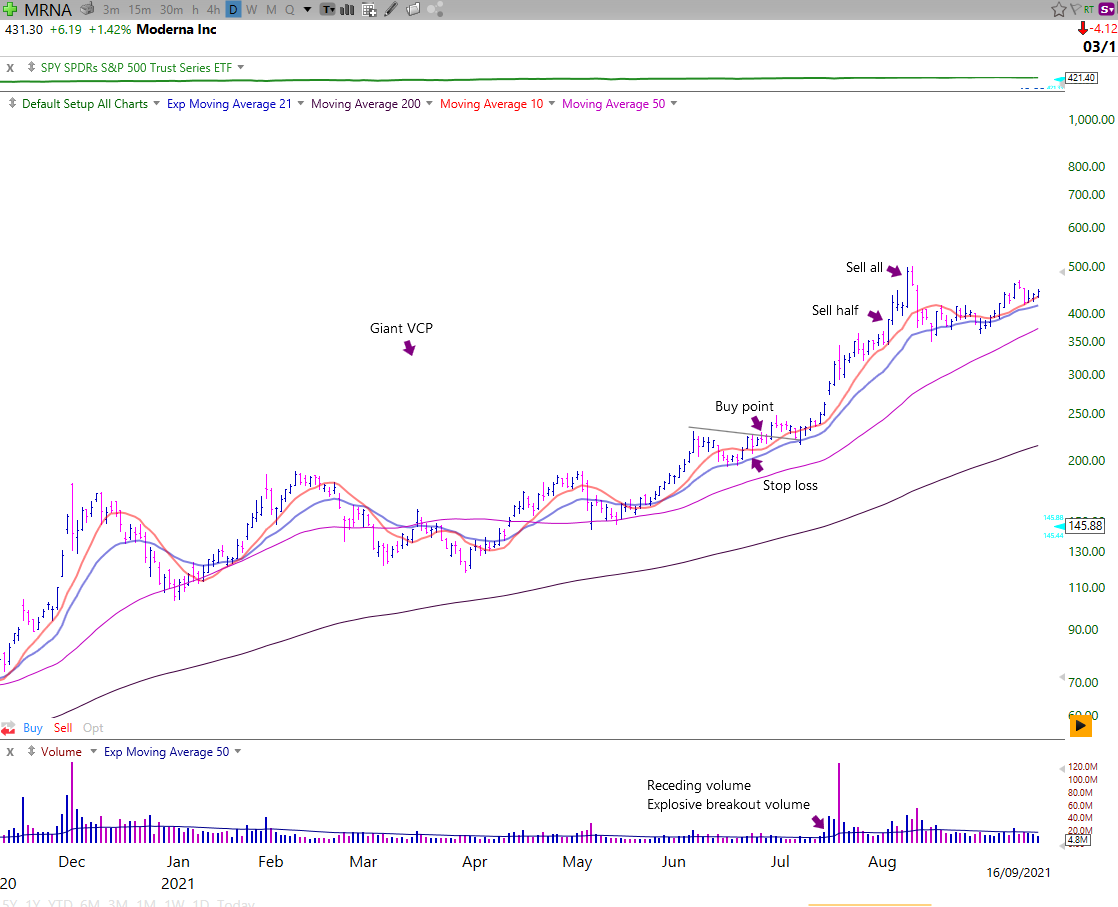

MRNA - JUNE 25, 2021 Trade

TSLA - SEPTEMBER 24, 2021 Trade

I highly recommend researching all of these buy points and burning them into your memory. The same goes for older stocks that have been huge winners, where would you buy and sell? This exercise is absolutely integral to picking good buy points and getting familiar with them.

Personal Observations

Some of the most striking observations about the difference in our buy points:

- I kept focusing on "home runs" instead of singles, this meant even profitable trades came back to break-even points when I should have sold half or more

- Mark sold into strength far more frequently

- I was buying too soon in the base and not letting the stock prove itself

- I was buying before the base was ready and being part of the shakeout areas

- I was not retrying high quality setups when they started again

- I was definitely over-trading or taking about 30% of all trades outside of my screening criteria. This by far hurt my performance the worst.

- Mark's entries show far more patience, not jumping in before the stock has really shown it's strength

In my trading journal, I have begun rating my setup quality to make sure I pick only A and B grade setups, my leading performance indicator is going to be pushing out low quality trades and developing "sit power":

Subtle Differences Make a Huge Difference

One of the most inspiring outcomes from this review and other I have seen from great traders like Lone Stock Trader (check out his blog), Mark and others, is just how close so many aspiring traders are to doing exceptionally well.

Many aspiring traders and a few guys I coached (I don't coach anymore as it's too stressful), were actually very good at analyzing setups. The problems were not really around analysis of charts and buy points but mostly around psychological habits that have built up over the years and sabotage their success. The very same habits which have created a draw-down for me this year.

If most traders could simply focus on the back end of their performance such as:

- Buying too soon or bad setups

- Selling too late hoping for "the one"

- Genuinely trading their plan vs random buying

They would probably be very successful or at least on track to be successful. I honestly think this focus on money and other ideological bullshit perpetuated by social media is where people are getting crushed. We want everything now and are not willing to work for it!

The money is in the process. I learn this more and more each year. Nobody will build and execute this except you.

After having several very good years of trading, I definitely got lazy, thought the market would keep rewarding me for buying sloppy setups and have been humbled this year in a big way. I am confident others have also been humbled, particularly crypto permabulls and Stocktwits who have randomly gone "quiet". Good.

For me personally, far less time is spent fantasizing about a new house in the Alps, far more is being funneled into performance and self-discipline. This is empowering, humbling and opens up new parts of my development I never knew about, what an amazing opportunity.

The Newsletter

Sign up to get a monthly email about my trading journey, what I learnt or failed to learn and receive exclusive access to unpublished material and resources.

Build Confidence by Doing

Interestingly, even though in a mentally demanding draw-down, looking at Mark's results and performance gave me tremendous confidence in how far I have evolved as a trader. Mistakes that were commonplace a few years ago such as:

- Worrying about losses

- Not having an actual trading plan written down

- Shooting from the hip

- Emotional reactions to gaps

Are now really limited. I think it's funny though as looking back I really thought trading was going to be easier, now I see it's the hardest easy money you will ever make. It takes serious commitment, introspection and time to understand what it takes to hit the big numbers. Learning how to immerse in the process instead of being driven by emotion and money is certainly one of those keys.

Even though I have mismanaged my account this year, I did many positive things in the last few to secure myself in terms of buying a few apartments and taking money off the table that could hurt my lifestyle. So I have the freedom to slow down, review an elite traders results and clearly assess my performance gaps against one of the masters of our generation. This is like being in the jungle with a sniper teaching you how to shoot without being at risk of being shot!

If you are serious about trading, I highly suggest reading Mark, O'Neill and just a few more books on momentum trading, I review them here as well for those interested https://blog.redpilltrades.com/my-3-favorite-trading-books-of-all-time/

More importantly. If you are reading this, get to work, review those charts and know thyself. Life is short, don't make it shorter by buying shitty stocks and gambling :).