This year has been a challenging environment for traders and investors as a big money has moved from the high flying tech names into "bricks and mortar" or commodity plays. As large investors or institutions begin to price in rate hikes, the switch has flipped from growth to value.

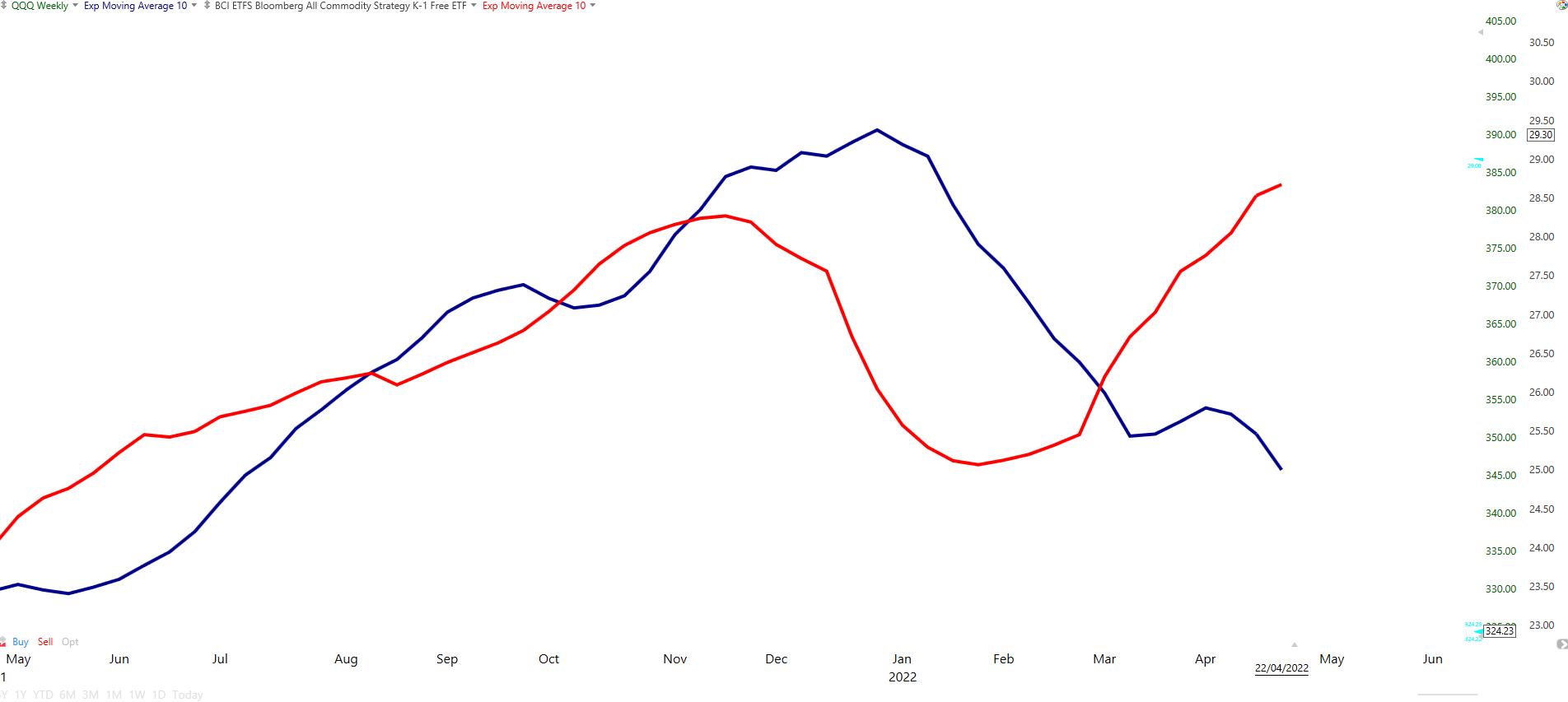

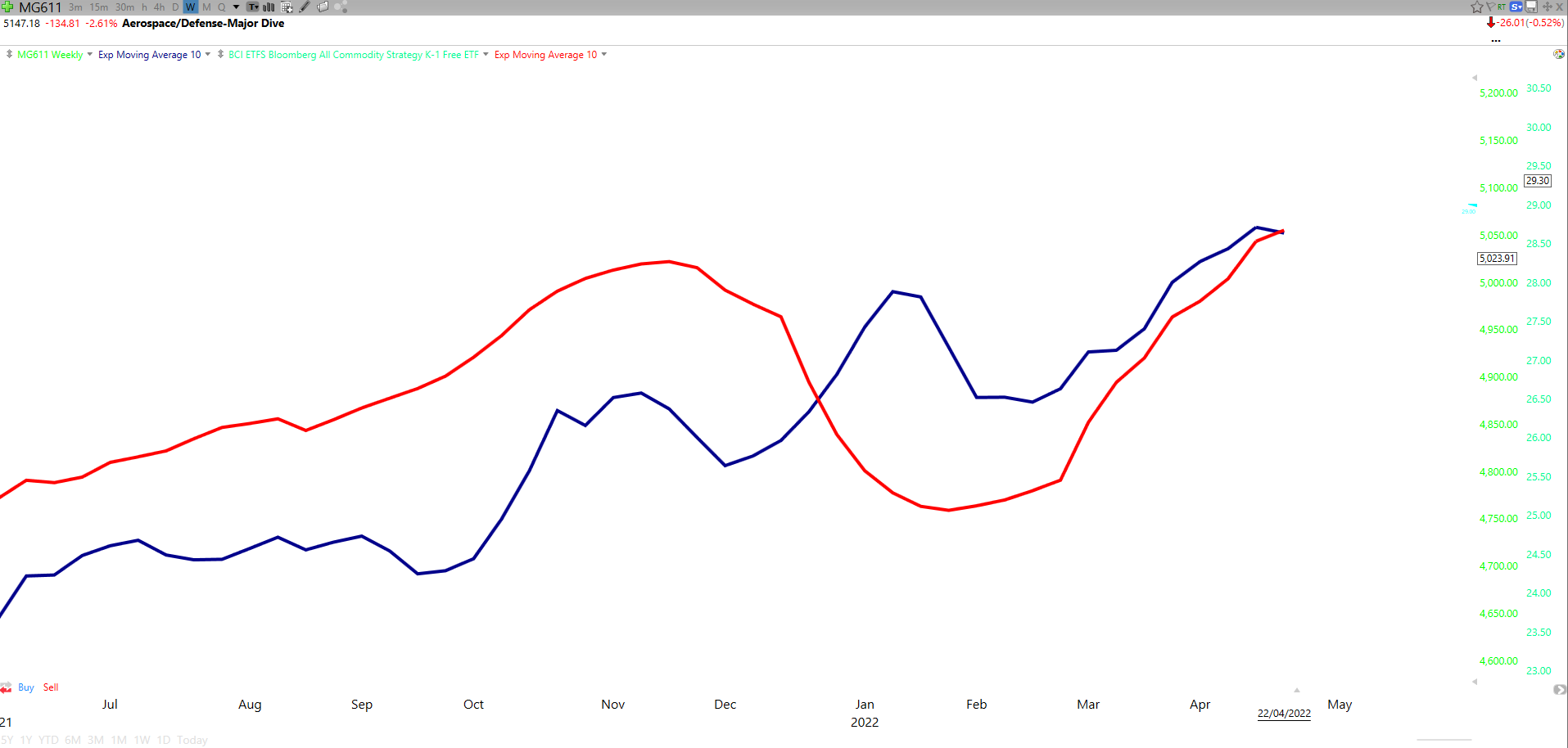

The below divergence in price action shows how commodities (red) have flipped the Nasdaq high flyers (blue) which are currently pinned under the 50 and 200 day moving average and have a serious amount of work to do to unwind the prior selling.

There are some fundamental questions lingering in all trader's minds about "what is next", will the divergence continue and just how far can central banks go to course correct?

For growth stocks, the future looks particularly grim as the "IBD 50 Fund" has broken down hard and also failed to rally even close to the 50 day moving average, it didn't even re-test the 50 day and shows little in terms of interested buyers:

From a price action point of view, the bears are truly in control. Recession appears more and more unavoidable, once the penny drops in the stock market, it's very hard to maintain the real economy as buying power from people's pensions slowly decays. The lack of spending power can result in a deflationary recession where fiat money can store value vs equities and other assets which reduce in value. I think however this could be temporary reprieve.

As we called this inflationary narrative long before it hit the street, it's always good to ask what is next? The banks have a real challenge on their hands to raise rates and deflate assets because of the following:

- Central Banks unleashed too much credit with no oversight in the first place

- Tight supply chains and nationalism have increased due to income distribution disparity

- More pressure on governments due to unruly "peasants" suffering increased food prices

- War in Ukraine, adding more pressure to the food and energy crisis

- Changing ideological landscape "East vs West"

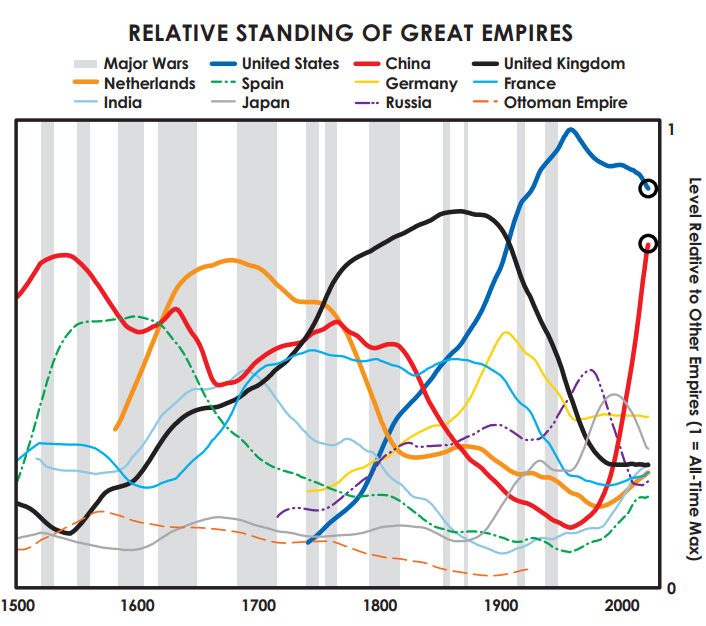

Most of what is happening aligns warily with Ray Dalio and other macro manager's theses around rising and falling empires. For more depth on the matter here are some suggested reads:

- Changing World order

- Currency Wars

- Why Nations Fail

- The Nightmare of the Weimar Republic

For a snapshot summary of the falling empire narrative "The Changing World Order" gives an interesting comparison to where China and the US are in terms of their relative standings as great empires:

Let's take a quick look however at where we go from here.

Inflation Forcing the Fed Into Action

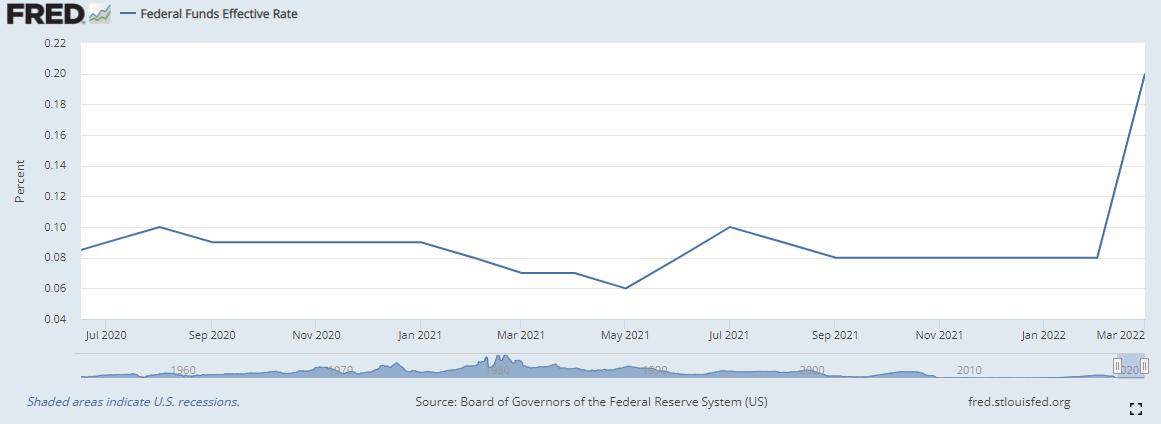

Due to the inflationary forces, the grand money manipulators, known as central banks have been tightening their purse strings and have been promoted to increase the cost of credit. (the funds rate) as below:

With such a small raise in their effective rate, the stock market is already breaking down. The big concern of course being, if they raise rates higher to cool off inflation, equities and highly debt driven bubble assets could get clobbered.

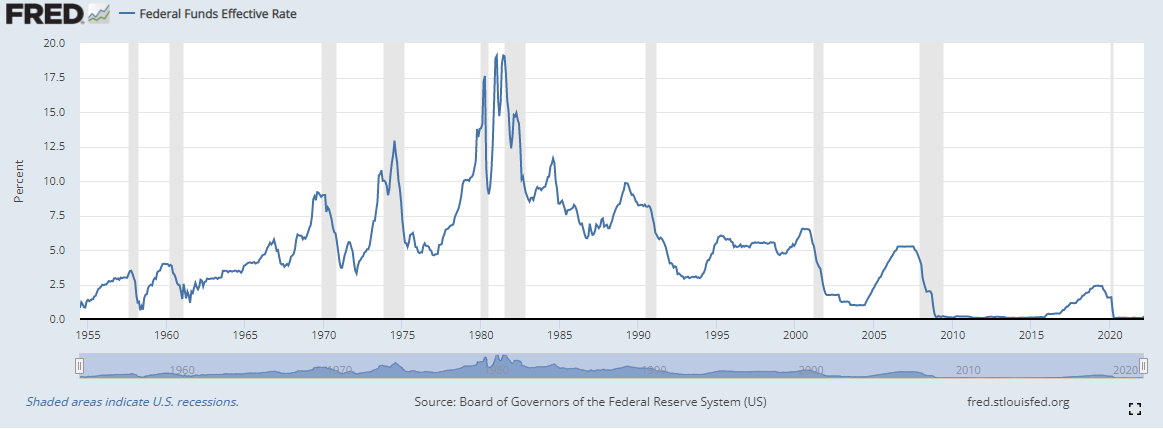

Looking at this on a larger time-frame it would be healthy to have some fear right now and be on the sidelines in cash or in some form of income generating position. Specifically if you look at the historical funds rate, we have not even begun to tighten the belt enough to have a large impact:

The chart above shows the impact of raising the funds rate and grey areas indicate a recession. Do you see a pattern here?

- Each time the FED cant raise rates a recession ensues

- Since the loss of a "gold peg" the only answer has been low interest and excess liquidity, making it harder to raise rates

- The growth of liquidity and low interest was closely correlated to stock market growth

The summary being, the fed can't really raise rates but has no other choice. The fundamental story of debt, supply and demand and the real economy has caught up to the fiat game.

"Pushing on a String" What Next?

So basically, what happens next?

If they (central banks) raise rates, they kill the market and all the boomers with it. All the pensions, retirement plans and liquidity as growth narratives will begin being falling apart as there is a flight from equities. This will indeed cause a large recession in the real economy as less credit is less growth (basically).

If they don't raise rates? Essentially we will have a Wiemar Republic episode with runaway inflation but very little growth due to the supply chain issues and geopolitical ones. It is no surprise to see why now is an opportune moment for Putin and other plays to make a move on the US in a financial war.

So the bank is basically left with one of two options:

- Raise rates and kill lending, pensions and equities

- Don't raise as fast and cause stagflation. Inflation on prices but no growth

The final result is, they are "damned if they do, damned if they don't". Even if the stock market continues up (inflationary), buying power is reduced, if it goes down, buying power is increased but there is limited availability of goods so countries will begin to horde their own supplies causing inflation anyway! Inflation without growth is stagflation.

There are almost no options on the table indicating the FED can push either way and the result will be the same - a complete and utter financial fucking disaster.

Could This Mean World War III?

An interesting correlation to the current inflation in commodities prices is the lock-step correlation with the Aerospace and Defense industry as depicted below:

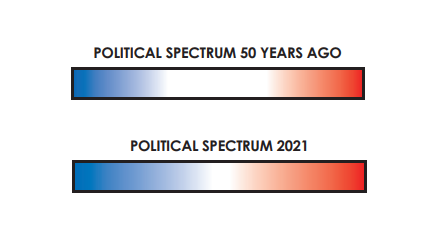

Combine this increased inflow of capital into the arms industry with an increasingly divided political spectrum, inflation, and food shortage, what do we expect to happen?

Summarized, at present we have a lovely cocktail of the following:

- Inability of the central banks to avoid recession or stagflation

- Increased polarization and a widening political divide

- Wealth disparity at an all time high

- A rising and falling empire

- Big money cycling into commodities and risk averse assets

- Food shortages

- Rising popularity in nationalism

- War and proxy war

- Competition for the IMF currency basket

- Idiotic politicians

The big question is how resilient is the global economy? Is the music about to stop?

Personally, I have no idea what will happen but statistically and by using historical precedents, I don't know if I would bet on a bull market in equities anytime soon, here is what I will be doing:

My Game Plan in a Nutshell

I am raising cash and waiting for a very clear trend to develop before committing large positions.I have two major theses:

- They will realise they can't raise rates and we get a bull run but more than likely in other sectors such as commodities and real economy

- They will raise them and we get a recession where I will hold cash

My plan

- In both circumstances I will keep my property but not add anything else to any portfolio in the short term

- I will hold some physical cash, add some longer term foods to my house (yes I need a tin foil hat)

If the picture really is as grim as the data suggests. I can see a true threat to democracy, how things are done in the West and likewise what currency and instruments can retain or gain in value. Could we finally see modern monetary theory (communism in my opinion) ushered in? Will there be political revolution?

My game plan for now is to monitor all the markets VERY closely and make sure I have enough liquidity to buy, sell or run and hide in the mountains. One thing is absolutely certain - nothing at all is certain.

Liquidity is king and very soon we could have real blood on the streets.