A Note on Risk

I really get tired of people saying trading is risky or as alluded to in other posts "Gambling". There are many types of risk in the stock market and being on the sidelines could be the worst of them all.

Few people understand the magnitude of what is happening in a global context regarding how much money supply is being created, the convergence of debt, social change and other geopolitical factors are influencing their spending power. The express ticket to knowing what is happening is... money supply up... your money worth less.

If you don't believe that inflation (at least in terms of M2 money supply) is real let's take a look on the official FRED website and the latest M2 money supply.

Money supply is going parabolic. There is more money than ever which means our buying power decreases relative to the assets that this "liquidity" is propping up. If you take a look at another metric (USA based), the average national salary vs house price ratio tells gives us clues to our declining buying power in terms of hard assets.

Note on the above: source is my own data input into Wolfram Alpha and is ratio of median home sales price vs median household income. This means in 2012 the ratio was 3 whereas in 2020 it is around 4.5.

The bailouts used to prop up institutions have both inflated asset prices (stocks, bonds, houses) and at the same time destroyed purchasing power in real terms. The rift created by this "us and them" distribution of the money supply is creating winners and losers.

Investing and positioning is a great defense against these silent killers. The invisible hand is no longer invisible. The only game in town right now is print.

Sprinkle 0% Interest on Those Savings

To add insult to injury, the interest on this money if kept in the bank or individuals is 0%! In some cases, we even have to pay for the 'privelage' of a bank holding OUR money which they use to loan to others and charge interest on it. Unlike banks however, if we lose all our money, we have nothing left. If they lose all our money, they get a a little booboo on their bonus .

What the actual flying fuck, even writing this just shows how absurd this is!

If you don't believe me, let's consult some publicly available data, again from FRED:

So we have the printers pumping out cheap money and can't keep it in the bank unless we want to lose it.

The entire goal of this low interest is to stimulate spending and prop up this absolute shitshow of an economic model. We are left with empty apartment blocks, stockpiles of food that is left to waste and companies loading up on cheap debt.

The lower ranks of civilization, also known as the other 99.9% seem to struggle to get loans under 10% APR. Ad infinitum the system continues in our boom and bust cycles with the sprinklings of a revolution or shift here and there. Human nature does not change.

Growth at Any Cost

The simple reason these financial storms are brewing is because our economic models are built on flawed premises of perpetual "Growth". We need to grow GDP, automate everything and make sure that everyone has more (at least consumes more). This is usually in the form of cars, houses, shiny distractions and anything else that can take our attention away from just how ridiculous the system is.

The central banks have basically said to us - here is loads of money, now go and spend it or you will lose it. Thus the creation of an unstoppable force is manifesting which inherently forces people to pursue 'growth'. If you look where most of this growth goes it's typically around things that enrich companies that can market to the less privileged to give them a taste of the "good life". This is what the good life looks like:

So while I can't deny I do enjoy the odd Steak, Whiskey and puff of the devil's lettuce, it appears at face value that our incentive structure may be... just possibly... totally messed up! So you may not be able to buy a house anymore but my word, drown out that silly distraction with another smoke, stuff your face until the anxiety goes away and stick your head into the sand.

Another possibility could be learning from this and preparing trading it but that sounds like hard work.

Growth for Who?

So let's set our Austrian vs Keynsian cheeseburger eating Americana models aside.

We have this massive pump of money, no interest and are forced to spend it. That would be great if the helicopter money theory worked but if we look at the velocity of this money (the speed at which it gets to us, the serfs) there is a real disconnect between what is happening in reality and what is happening in the financial world. Again, totally public data, no "conspiracy" here - just factual info.

So all of this money is being printed but is not hitting the real economy. Instead it is used to prop up failing companies and maintain the status quo. There is no bailout for individuals or small business, only for the "to big to fail" types.

What This Means for You and Me

Okay so what does this mean for the person on the street?

It essentially means that our money (yes it is ours technically) is being used to prop up zombie companies that have been managed like shit. We then have the privilege of keeping our money in these institutions so they can take it if it goes tits up again.

- Airlines - destroyed overnight

- Hospitality industry - destroyed

- Car manufacturing - bust

The same institutions ask the serfdom (us) to save for a rainy day yet claim bankruptcy within 2 hours of a pandemic announcement.

Seems like a great deal.

Just to sweeten this absolute chicanery, many people in the modern economy don't have access to the low interest mortgages and loans which are the entire point of these stimulus packages. The system inherently is designed to cut people out of the inner circle and push them into debt that is hard to service. In the same breath we reward and bail out these monoliths to avoid job cuts.

I don't recall jobs ever being kept though... do you?

Essentially we guarantee money to inner circle and starve on it's periphery. Just as the constitution was created to preserve the rights of business owners, the current economic paradigm guarantees a system where we are subservient to companies and will never be bailed out ourselves.

Some countries are an exception but in a macro context, we have to be smarter, faster and position our trades or portfolios on these premises.

Money Flows Upwards

The essence of what we are seeing is practically a sub-par implementation of a global pyramid scheme where those at the very top have created inherently challenging rules in order to maintain their power and at the same time keep people comfortable but not wealthy. The exchange for this system is jobs, luxuries and of course a standard of living where we can all function as a society. I would agree with this but as you may have noticed:

- When the shit hits the fan, companies get money, people get unemployed - so we aren't even guaranteed jobs from this!

- The government when drowning in debt, raises taxes... to bail out the companies (lol)

- There s no financial prudence or real capitalistic incentive structure

The potential good news is, there are alternative assets which aren't going away and may create significant opportunity should the shenanigans keep on happening, which they certainly will. I will write on cryptocurrency, gold and other ventures in more detail soon.

Liquidity and Economic Mechanics Gridlocked

Perhaps one of the worst issues to compound the misery at the moment is the advent of the Coronavirus. Even though the bank is printing to high-heavens if we look at the employment rate in some key economies for instance, the USA, they make the great depression look like a walk in the park.

So the storm ensues with banks refusing to hand out essentially free money to the general public (who need it most) and thus the birth of MMT or "Modern Monetary Theory" ensues where you see things like $1200 checks given to people impacted by the mess. I would suggest really digging into Ray Dalio as I love his work on this and how it makes sense of it all.

I am a huge proponent of bailing out the people and small businesses so quite like the idea of MMT and universal social healthcare.

Currently, the large sums of money are then given to giant companies cracking under the strain of less business and less so the people. If we look at the rally of the major indexes, a lot of the actual inflows are banks and organisations using the many new loan schemes from the Federal Reserve to prop up the economy. How else could the stock market look like this during peak crisis?

Enter Dystopian Reality

So let's recap the ongoing issues:

- Massive printing of money - thus increasing supply regardless of demand. The free money is locked in institutions and flowing downward as are the ridiculous theories. See Cantillion effect.

- High risk of default for many institutions from airlines, and banks to most service sectors. The debt just rolls from one organization to the next

- The risk of a second wave of Covid

- Central Banks outright saying they will do "What it takes" to keep the economy buoyant, never-mind growing

- Decreased lending to families and individuals due to the inherent market risk

- The poor getting poor and the rich getting rich

What an absolute and utter fucking shitstorm. Couple that with riots, and the worst wealth inequality we've had in the last 80 or so years and it doesn't fill me with confidence in our political and financial systems.

Corporate Socialism

This really enforces my perception that those in power stay there and that first mover advantage in a longer time series give people a tremendous advantage to compound wealth and or technology over many many years. If anyone stands in the way, simply buy them out, lobby your pocketed politician or in some cases - make them disappear.

People forget that it is out tax money and hard work that props up this entire show and I certainly did not vote to bail out the banks and prop up a false economy.

I had a funny chat with a close friend of mine and he put it in a way most can understand.

"It's like being a prostitute and having to pay your customers to fuck you. When they are finished you thank them for the privilege of being fucked".

Part of a Bigger Picture

Nobody can clearly call the future right now. If you're up for a good laugh visit r/Wallstreetbets who are making memes about this being a "Kangaroo" Market as we are all being whipsawed in and out of trades with up and down gaps of 5%+ on INDEXES! So if the super powerful institutions don't know what is going on, it is hard to get into a trend without it feeling like a game of buckaroo.

The thing about these economic issues converging at the same time, is that they really aren't anything new.

Just as every Kingdom, empire of government has changed hands, the stock market also goes through various transitions and paradigms.

It's Part of a Bigger Shift

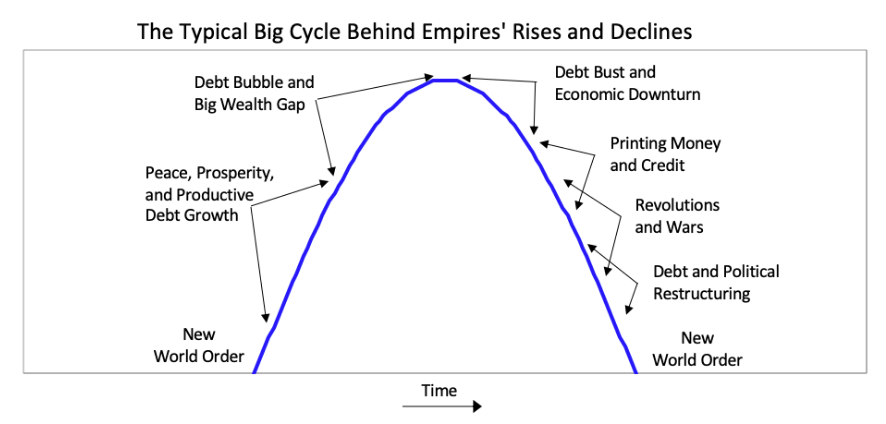

Dalio's team encapsulate these super macro changes and have done more research than mere mortals like myself could ever dream of. They classify these super cycles as below:

Funnily enough if we look back the roots of the existing world order (let's be honest, the USA has dominated). We seem to be on the precipice of a potential downturn or shift. The Covid black swan was not the cause of these issues but simply the needle that popped it and woke us up to the reality of the situation.

It is all too convenient for the media to blame Covid but if you see what is happening now from a social and political perspective, there have been many countries in full revolt including America where we have serious upheaval ignited by the murder of an innocent man by police.

Before Covid kicked off in fact, we saw emerging market currencies around the world falling by the way-side with debt mountains which needed to be serviced by.....drum roll...... money printing. So even if the US prints, the other nations have to print even quicker as to not be holding "expensive" debt and a weak currency.

This adds even more pressure to an already crumbling system. Ironically, the answer we have to solve these issues is.... print. It's truly incredible.

The Newsletter

Sign up to get a monthly email about my trading journey, what I learnt or failed to learn and receive exclusive access to unpublished material and resources.

The Emergence of China

Where would we be in a macro conversation with out mentioning geopolitical tensions!

The increased tension between the perceived rising Eastern blocs and degradation of the credit system globally shows a worrying relationship in the standoff between these ideologies.

Again from Dalio's debt crisis thesis, this brings us closer to the "Revolutions and Wars" part of this archetypal cycle. A blind man can see that there is a stand off splashed all over the media where both parties have the propaganda engine in full swing.

The data is there, we have sponsored the rise of our own alleged enemy by creating massive trade deficits in order to consume until our heart's content. It is well documented that in Chinese warfare, one of the key strategies was to kill you with kindness. Once you are weak, fat and redundant, it's time to pounce.

Presently, we have a beautiful convergence of:

- Wealth gaps

- Downturn

- Printing money

- Revolutions

- Possible war or existing proxy wars between major nations.

Coupled with a very close intersection in history where power may be shifting to other economies, the headline risks are prevalent. It's important to remember war is not only physical, war can be fought economically, emotionally etc.

What Happens Next

There are different debt cycles that have occurred in history and each with a different impact and or effect. In the case of our current shift, the data suggests that there are so many factors to consider in trading that I am refusing to be more than 50% invested until the volatility dies down.

That is not to say that I won't get aggressive if it picks up but of late the market has been violent and uncertain. It's an important time to stay humble and trade lighter positions in the market.

I will not let the macro picture scare me away totally as you can see some of the cyclical shifts in wall-street from Tech stocks, back to bricks and mortar and then again into tech, the beauty of reading market flow is that the macro does not stop you from making profit on both sides.

Deflation

If the current trends and issues persist I can at least speculate on a deflationary period where the values of property and stocks in particular may go down, I don't think for long though. Of course this could be totally propped up by the federal reserve but when we look at consumer sentiment the demand for things in general seems incredibly subdued.

The result is inflated asset prices simply inflated by money supply as opposed to value. The real inflation on the ground, specifically that of wages is flat or declining. With declining wages and increasing asset prices there are now fewer players to enter the market.

Irrespective of the massive cash injections inflation is still flat lining in terms of consumer prices, once however the cheap credit takes hold and wage inflation or "free money" from the government comes into effect, I anticipate a renewed Corona rally in the ensuing months/year or so (all being well).

If we look at inflated asset prices vs the total assets on the FED balance sheet, the disconnect is too wide to have an indefinite recovery. The result is huge volatile moves for now which to me are risky not rewarding.

You can see exactly where this asset price inflation began. Suspiciously right around the alchemy of Quantitative Easing after 2008 or QE. The financial experiment continues.

Followed by Hyper-Inflation

When deflation occurs there is typically a drag on GDP growth, less cash is sloshing around even in the doughnut economies and we essentially have liquidity gaps (no money sloshing around).

As this begins worrying the central banks there is increased pressure to get money back into the economy and deregulate industry to spur on growth, or create some other financial wizardry. Huge surprise how 2008 happened? Who would have thought it would go wrong.

The problem is however that by the time the money hits the general population, all asset prices have gone up yet again leaving them on the sidelines. Money becomes worth less, asset prices go up and more people are cut out of the real economy.

To regulate or stimulate spending on the street, wages need to rise to enable people to enter the economy and be worthy of debt (lol).

Although I am not saying we are heading for a Wiemar republic style collapse (below image for a loaf or two of bread). The very same characteristics are playing out now. The only tools left for central banks are stimulus or negative interest rates - both unproven to grow anything other than new bubbles.

I for one want to be able to spot this trend and trade it. If the inflation is not properly managed too much credit and easy money creates upward pressure on asset prices. This balancing act has gone wrong far too frequently leading to huge inflationary periods where cash loses its value almost daily.

This cycle needs more than a blog but the take-away message is this hoarding cash during inflationary booms is the riskiest trade you could take.

How You Should Trade It

First off all, the charts, volume, price and the action of the market gives you all you need to know about when to get in and out, this is your ultimate guide.

This does not change because of Macro factors at hand. In fact, these same factors are clearly seen in the price action anyway! (A.K.A the Kangaroo market). The current choppy nature of the market shows just how worried central banks and institutions are about their position.

So much so that the central banks have outright been buying bonds and even ETF's outright in the stock market. This could put a very nice floor indeed in the stock market and mean that stocks will look very attractive indeed to trade.

This purchasing program really is the pinnacle of the corporate socialism gig as the central banks prop up the system by directly interfering with the mechanics of supply and demand economics. It's happening so quickly with so much cash that the best hedge funds don't even know how to position for it!

We Could Get a Bull Market Like no Other

During these times the beauty of being a trader is very obvious. You can sit quietly and wait for these forces to impact how people perceive the market. You will see stocks flying high such as technology due to Covid and then airlines crashing at the same time.

These moves have been violent and hard to trade due to the whipsaw nature of the market. In fact, you can see people capitulating left right and center with some having huge astronomical gains and others losing their shirt.

In such times the best thing to do is focus on the cleanest setups. Lower your risk and let other traders lay the groundwork for the next run - or fall.

If the corporate socialism theory plays out, Bitcoin, Gold and other assets may become more and more attractive as we prepare for what could be an extremely huge pump followed by an enormous dump.

One certainty is guaranteed, for those who know how to trade, opportunities of a lifetime are developing in front of our eyes.