There is only feedback no failure. Resistance and suffering are a clear message telling me what I need to become aware of - Dr. Van K. Tharp

2020 was incredibly interesting and the aftermath of "QE infinity" is far from over. Everyone is wondering if we are going into a parabolic market rally or about to nosedive again and head back into choppy seas.

It's times like these we rejoice being traders. Either way, if the market goes down or if it goes up - opportunity will always present itself. Managing the opportunity and risk of course will be more important than ever at these levels of elation. They are usually followed with periods of despair.

I wanted to take a moment to reflect on the trading year for me and share my key lessons or improvement areas. Even though I missed some large opportunities, this year was highly profitable. In saying that, I truly feel it could have been "life changing" had I managed a few thing differently.

Let me get stuck straight in; I have about 3 or 4 accounts so will screen shot the % gains but don't to share dollar gains for obvious reasons. If you want to audit me then I have no issue with that, reach out to me via direct contact.

This has been a "different" year for gains. At the end I will recap the psychological misfires that I will prune out and re-shape in 2021:

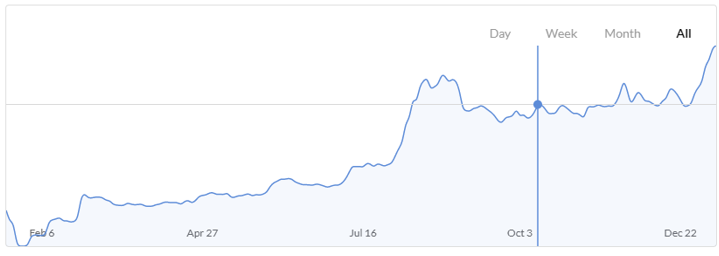

Account 1: "Betsy"

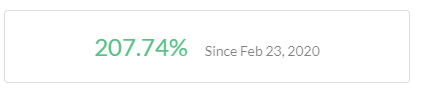

Total gain as of writing:

I decided to experiment and trade a few accounts with the same rules but different position size. "Betsy" was standard position sizing with max 2% Risk per trade.

The hardest part of managing Betsy was the draw-down around August. I almost messed with position size but decided to stick it out. This came from back-testing my strategy and recognizing it's better to keep uniform positions vs eyeballing it!

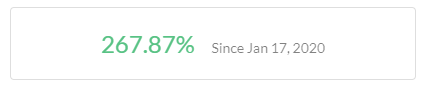

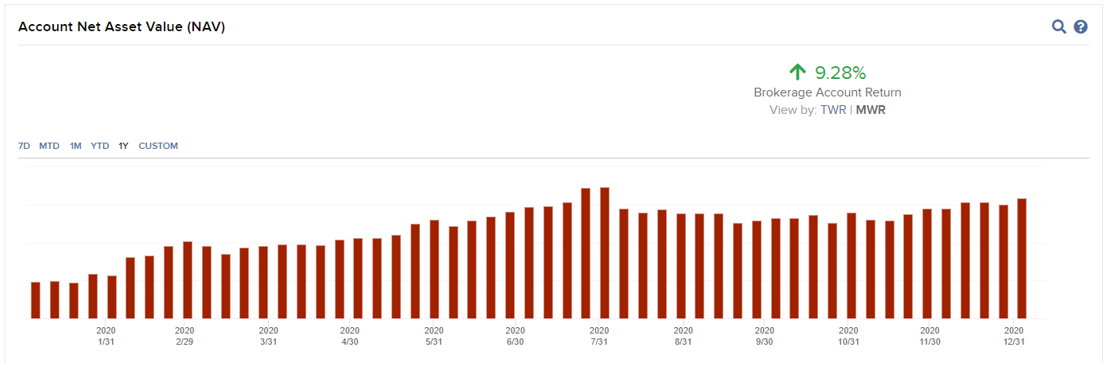

Account 2: Alan

This was an experiment in digital assets. No need for comment I would Imagine. All using principles from Mark Minervini, Nicolas Darvas and William O'Neill's books.

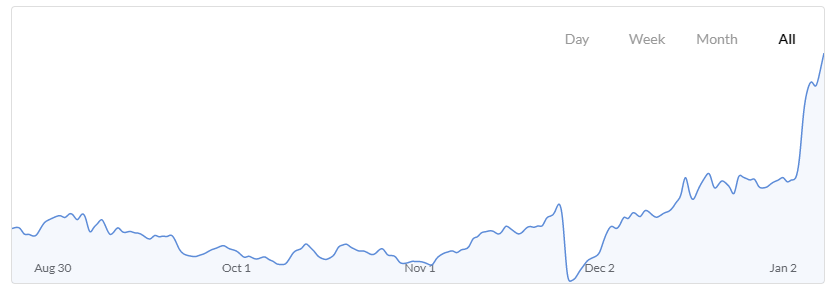

Account 3: Gertrude

Similar to the other accounts, using the principles of my strategy has paid dividends in 2020.

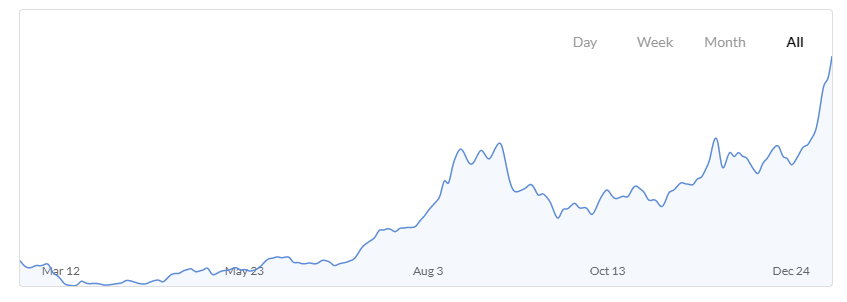

Account 4: Big Bertha

The "large" account where my wife and I put our savings and investments (but is actively traded):

I wrote a recent blog about missed trading opportunities and this encapsulates what happened here, I really screwed around with the rules on this account primarily due to fear.

So from a results perspective, other than account number 4 this has been a very profitable year!

My Trading Stats

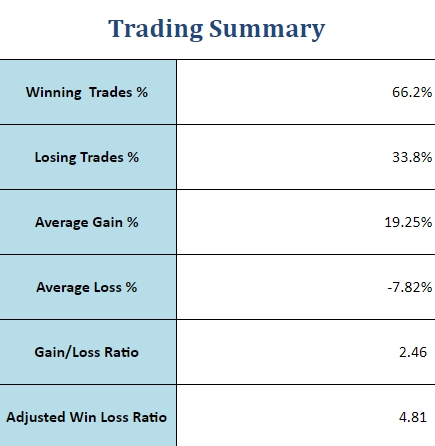

Probably one of the biggest lessons I took from this year was using a trading journal and tracking my risk and stats. The below

The culmination of my profits and stats resulted in the following key take-aways from 2020

- Making assumptions on market direction cost me 6 figures of potential profit.

- Selling positions before they have had time to play out is both stressful and expensive.

- Buying stocks too soon or FOMO trades are still present in my trading but I have reduced them by over 40% from last year.

- The stress response to adverse price action needs to be managed to allow the trading edge to play out!

Some Positives

- Via using meditation, psychology and philosophy I have greatly reduced trading stress and altered faulty beliefs - I totally believe I and anyone else can make money trading.

- Understanding the value of practice has helped me slow down to speed up. Marking up charts has and using old charts as reference has been invaluable.

- Sticking to the same system and becoming a specialist vs a generalist.

- Staying away from cheaper stocks mostly stocks under $10

- Not panic selling during adverse reactions and responding in a "triggered" state.

- Staying away from social media which I wrote about about here was another life changing move, and I do not miss it one bit!

- Sticking with the discipline of j a trading journal is perhaps one of the best things I have ever incorporated into my trading.

Quite obviously managing multiple accounts has also been up and down particularly when my wife's savings are on the line! I noticed that whenever I was putting on positions they were far too small and profits were taken too soon.

Using this data to shape my behaviour and form new habits has been the cornerstone of moving from novice to semi-professional. It is my intention to take this information, incorporate it into my trading plan and truly focus on the execution of the plan in 2021. By 2021 end this will be my primary income stream.

Each year I have improved both my trading habits by reducing or pruning out the most common mistakes:

- Over-trading

- Emotional responses

- Cutting winners too soon

- Putting on too much risk

- Selling too soon

- Not following the rules

It is truly paying out and has done so in a strange but interesting year. 2021 will also no doubt be filled with opportunity as the printing press runs hot. I for one don't know when the music will stop - but I fully intend to dance while it's playing and leave when it ends!

Happy trading for the year ahead. Make sure to get in touch or drop us a comment.