One of the real privileges of having a trading blog is I get to talk to and answer questions about common trading "issues" from all walks of life, countries and backgrounds.

As in trading, as in life, I notice some very peculiar patterns developing in my conversations. Specifically, what people are struggling with and how they grapple with the paradox that is trading. In many cases, system problems become emotional problems and then the emotional problems ruin the system. It's a vicious circle.

Even though we are all from various walks of life, a few commonalities show up in coaching and sharing sessions:

- Some are in a challenging financial situation - with either too much or not enough money (yes some people have too much money, first world problems).

- The wealthy ones are trading to relieve boredom and actually have gambling addictions in disguise - something my own psychologist pointed out

- Some are under pressure with money and trading is an escape to riches which leads to going too heavy too soon and destroying their account and confidence

- Many have very ingrained beliefs about the market before they trade which keep them stuck in faulty beliefs about wealth and trading

- Few (myself included) want to hear the actual truth about their system and don't do the hard stuff like a trading journal, around 5% of people log their trades

- Few people practice and back test trading.

- Very few if any have a written plan and process on which to escape the 9 to 5

The biggest commonality of all being, everyone expects it to be far easier than it is. Particularly those who made a ton quickly and then lost it again. Seldom does anyone have a tangible plan, written down with cash flows, costs, expenses or a vision of what trading full time really is.

Most people want to be trading at Super Performance level but haven't even managed their own household finances (if you feel attacked by this statement maybe there is some truth?).

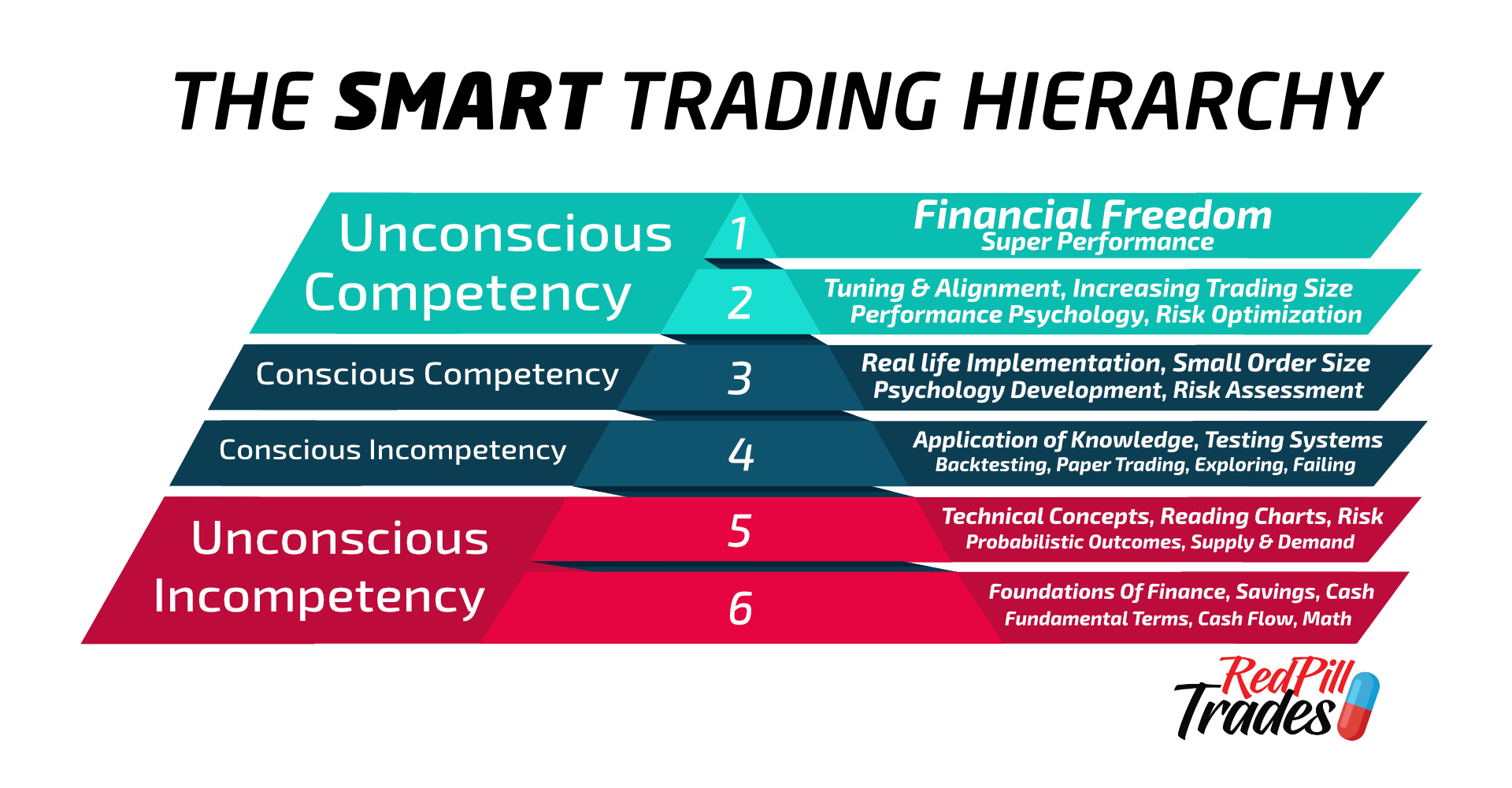

The "Smart Trading Hierarchy" above gives a good gauge on which platforms to build. A great place to start is finding out where you are in this hierarchy.

Most people want to hit 1000% annual returns (who wouldn't) before they understand core concepts about savings, cash flow and trading stocks as an actual business.

Not all Foundations are the Same

Many of the mental and financial foundations I've found are quite loosely defined, something okay when tinkering with stocks, not okay when your kids depend on it.

Having gone through this metamorphosis myself, I think that most of underlying issues are the same. There are a few pillars to creating a realistic trading business plan that people need to consider - both psychological and financial, they are inextricably linked in fact. Excuse if I am preaching here but I know from personal and very painful experiences, what works and what doesn't!

Your Psychology and Income

I've written before about what it takes to trade from a cash-flow perspective but seldom write about the stress(es) it takes to get there. If you have a situation where you are trading to live, the impact on your psychology is constant both conscious and sub-consciously:

- You can't guarantee the market will provide a recurring return which results in worrying about trading before you have started trading. More on Fear and trading found here in depth.

- In the back of your mind there is always a "plan B" to "go back to work if it doesn't work out" ,which in essence lays the foundation for being okay with ultimate failure. If you anticipate you can go back, it's easy to let mistakes into the plan.

- Dollar amounts become tied to items, events or experiences where you "could have used the money". If are trading a 100k account and not used to it. You could equate a 1% loss to losing a trip away with your wife and kids.

The Income Itself

I've written in depth about what it takes to trade for a living from a cashflow perspective but really need to hammer it home. The full article can be found here.

The thing is, I've traded for a living whilst I had a mortgage and also traded for a living without having a mortgage (paid off mortgage). In my early trading days I was far too inconsistent to pay any mortgage reliably based on trading.

It is impossible to separate these thoughts particularly if you are new to trading and are just in it to make money. One of the best decisions I made in trading was to stop focusing on the money and begin fine tuning the actually process.

Far more new traders should be focusing on saving and building a nest of assets before they even consider trading. That doesn't mean "don't trade" - it means stop smoking hopium and realise that if you really want this, it takes time and quite a lot of time. The tuition of trading can be steep, if you aren't ready for it then save longer, trade less and develop skills not "wishes"

The Newsletter

Sign up to get a monthly email about my trading journey, what I learnt or failed to learn and receive exclusive access to unpublished material and resources.

Trading Whilst Holding High Interest Debt

The thing about traders is. we are inherently interested in compounding our gains and having a statistical advantage in our favor to make money over time. In essence, making compounding our biatch and running our system day in and day out.

Debt is basically the exact same principle, only the money goes into someone else's pocket.

Just as positive compounding works with you, debt at high interest compounds against you. It would be the same as having a trading account that is guaranteed to lose say 5 or even 15% per year! Even worse, imagine taking our a loan and your trading account goes south. You are now tied into monthly payments, are down the money itself and can't find new opportunities to trade... because you never have any money.

Trading whilst holding debt is absolutely and unequivocally insane! Particularly if that debt has high interest. One of the most fundamental things we can do as traders is exercise basic financial prudence before trying to beat the best minds in finance to make money.

Creating a Solid Foundation on Which to Trade or Invest

There are far too many hurdles both financially and psychologically for anyone to hold huge debt and not hold basic financial literacy.. and then trade.

Not only do you risk losing more than you invested, you could put yourself in a financial hole which takes years to recover from and will turn trading into something very ugly indeed. The long term damage isn't always obvious at face value but can creep into relationships, habits and things outside of trading.

A sound foundation on which to ramp up your trading efforts looks more like the below:

- No overhead or high interest debts - exception is a mortgage that is well proportioned to your income and easily managed.

- Suggestion is mortgage insurance if it is cost effective in your country.

- Create and budget for realistic costs associated with trading. Write this down and create plans to get there. Turn the dream into something tangible.

- Have an emergency budget. Just in case things go poorly, it's always good to have backup, for me, at least 12 months of living expenses is a minimum.

Although less apparent and tangible, one thing I must include in a solid trading foundation is... your wife, partner or network of friends.

As trading is a holistic pursuit, surrounding yourself with the right kind of people is hyper important.

Even if you have the financial plans in place, your trading environment, where you live, what you eat, your physical health and other environmental considerations can come in to play, some very high level suggestions:

- Cut your losses with toxic relationships. Is someone is weighing you down or even worse - telling you what you want to hear! Seek truth in relationships.

- Make sure your trading office is clean, including files desktop and workspace.

- Keeping a clean and well balanced diet, reducing caffeine and stimulants which impact mood, adding complex carbs and reducing "quick fix" sugars which impact emotional state.

- Keep a journal.

I want to avoid over-complicating this write-up as many of these foundational aspects of trading seem obvious, even though they might be obvious at face value, few execute on them in reality.

Far too many people pursuing trading "dreams" have a weak financial foundation, hide trading from their partners (due to losses) and dig a very deep hole that is hard to escape.

As traders and investors, it's up to us to deal with and take full accountability for our trading results. The most obvious prerequisite of this being - a solid, simple and well thought out foundation on which to build.

Simple systems are always the best. Having a nest from which to fly makes all the difference both in a solid foundation and long term career in trading stocks.