Building a trading system can be a daunting task. There are literally millions of ways in which you can profit from the stock market. This may be options, forex, CFD's, stocks, spread-betting and many more.

I found it challenging to find a system that worked for me personally. With the amount of information available online, everybody claims to have the ultimate system yet few provide audited results to show how it has performed over the last number of years. It's confusing, full of unnecessary jargon and can lead you searching for a 'Holy Grail' that doesn't exist.

Luckily however, there are a few fundamental principles that every trading or investing system should have. This should guide your decision making when selecting a system. The below list is an absolute prerequisite of any and all trading systems. When investigating a system for yourself make sure you can clearly identify the following:

The Elements of a Strong Trading System

Below I will walk through my own analysis of a recent stock purchase. First, let's look at the elements common to most systems.

- The system gives a clear signal for when to buy. This can be breaking over a certain pivot level or above support/resistance, it really depends on the system you have selected.

- You will get a clear level or price point at which to sell the equity if the trade does not work out, also known as our exit.

- The amount you risk on each trade will be known, this can also be defined as R. So if you have a €10,000 account, and want to risk €100 per trade your R would be 10% (R=10%).

- Your system will have a statistically defined edge. This means, you are confident that your system will win more than lose over time. The easiest way to describe this would be as follows: If you have a coin that was heavier on one side than the other, the probability of it landing on that side would be higher. Even though it wouldn't happen every time, you would expect with some confidence that it would land there. Therefore, your edge simply means you have higher probability of winning as opposed to losing.

- Your edge has been proven over time.

- Ideally, the system will have some rules you simply can't break. One of mine is buying under the 200 day moving average.

- You understand why your system works and the logic and reasoning behind the decision making tree

- The system has stood the test of time. Personally, following the greats like Mark Minvervini, Ed Sykota and Nicolas Darvas leads me to believe my system is timeless.

- You can be wrong a lot and still make money. As is the case with all probabilistic outcomes, even with an edge you can still land on tails multiple times in a row. Your system should build failure into it's core allowing you the freedom and flexibility to be wrong and make money.

- Finally, your system should be easy to measure. You need to be able to know why you are losing, why you are winning and how to develop your edge over time. All systems that produce lasting wealth are measured. You can't manage what you don't measure.

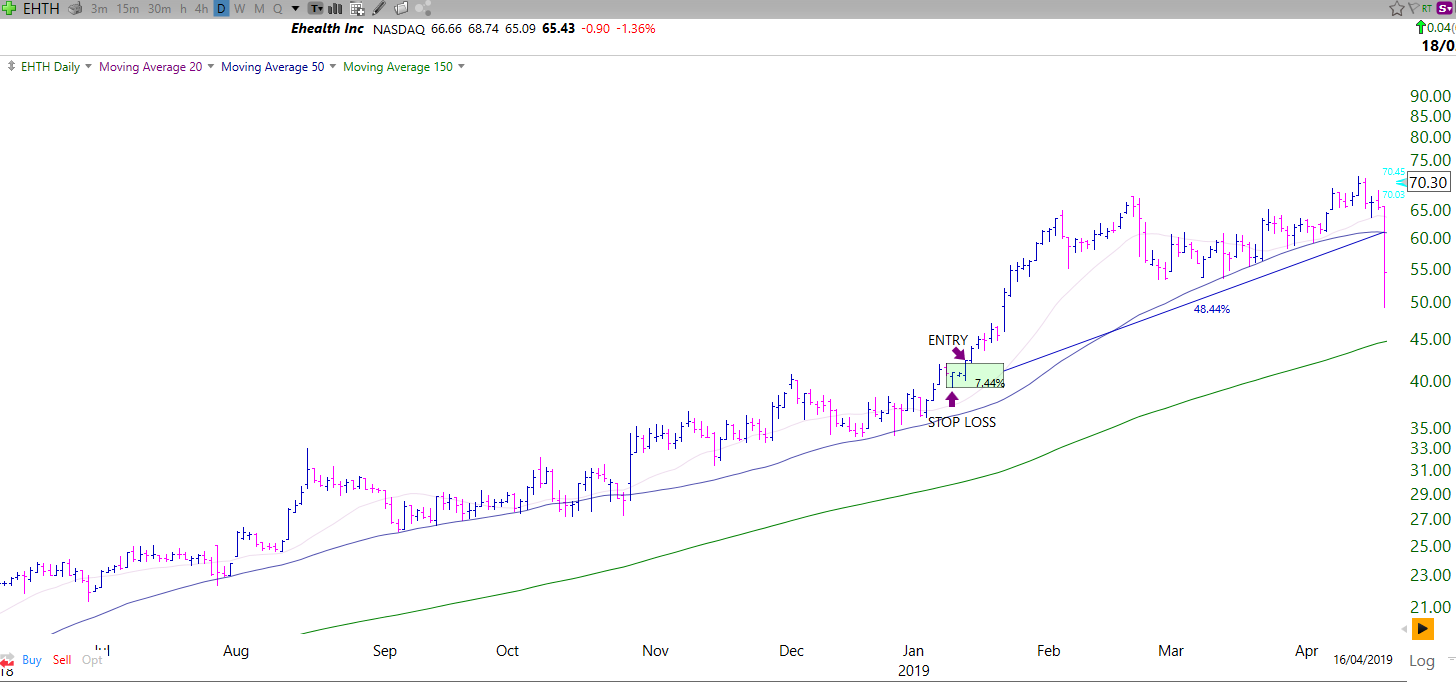

Example of Recent Trade in EHTH (E-Health)

A few weeks ago, as we were coming out of a massive pullback in the market with a 20% fall from the peak. Some stocks starting acting in alignment with my strategy (sorry but I can't divulge too much on the specifics as this has taken me years to develople). I will however give you some of the key elements below. This includes why I purchased and a sample of some criteria I used to find this stock:

- I had a clear buy signal on EHTH as it conformed to my maximum risk (R=7.4%). I will never buy a stock that has more than 9% Risk on the table. My buy point was clear, above the last high pivot.

- The risk stop was easily established due to the low pivot marked Exit. I was happy to lose if it hit my exit as the trade conformed to all of my criteria.

- As the stock was above the moving averages, as part of my rules, I was allowed to buy at this point.

- When compared to it's 52 week high, it was acting well and the volume and price confirmed the breakout.

- I knew that it was highly probable it would continue it's breakout without hitting my stop loss as very few sellers had shown up since the breakout.

- The final result is holding a 48% winner and having great profit potential on this trade.

The Newsletter

Sign up to get a monthly email about my trading journey, what I learnt or failed to learn and receive exclusive access to unpublished material and resources.

Example of Recent Failed Trade

Unfortunately, for every massive winner that comes around, there is always a loser. The trick is to keep the losers small and let the winners run. This below play in LRN killed me! My account was just cracking break-even and profit was on the horizon. The below is an example of a stock where I lost money by following my rules, only to watch it explode upwards and gain 27% (on the same day).

- My entry and exit criteria were the same as my EHTH buy.

- On the second and third day I was up in profit.

- On the final day the trade went against me, this not only wiped out all my profit but also gapped through my stop!

- The stock proceeded to rally far past the buy point and make a huge gain while I watched it on the sidelines.

The Important Part

Although LRN could have been a super stock had I not used a stop loss. I adhered to my stringent rules and took a loss. Although this is painful and happens more than anyone would like, it is part of trading. If you can't take small losses when trading a system, you will end up taking much bigger losses and eventually wiping out. This is why trading is psychologically intensive work. My system can be very hard to stomach at times but that's okay. If I flip the coin 1000 times, I know in my heart of heart's - I am going to make some very big gains.

Trading Systems and Personal Psychology

The interesting part of trading, like all other endeavors in life, is that each system or style needs to reflect your own belief system or paradigm. If you approach the market with a gunslinger type demeanor you may get lucky, but it is highly unlikely.

It is important that you acknowledge the different trading styles available and take your time to select one that can work around:

- How much capital you have to risk

- Your financial situation

- Work and it's demands

- Debt

- How you react to fear and or greed

The art of trading requires that an individual knows him/herself and can remain objective. If the market is approached as a giant open air casino, that's fine! Just make sure you know you could lose it all or most of what you put in.

Always Use a Risk First Approach

One commonality with selecting a trading system is risk. You can find hundreds of systems online that promise huge rewards and little risk. Although I agree with this in principle I don't think most people understand what it means.

You do not need to expose yourself to high risk to get massive results. You just need to know how to trade. It is far easier to add risk once you are being successful in the market than make a stunning comeback if knocked out of the market.Whatever system you choose, make sure that it is based on low risk and high reward. Be conservative when things aren't working and add more fuel to the fire when they are. These strategies are out there.

Finding a trading system is easy. Finding and mastering yourself with a system you believe in is not.

It's the repetition of affirmations that leads to belief. And once that belief becomes a deep conviction, things begin to happen. Muhammad Ali