Cryptocurrency is mystery to many. It's recent popularity perplexes most classic investors, particularly the exorbitant return. Why are teenagers becoming millionaires on "Dogecoin" (a currency based on a Meme) as many boomers head back to their 9 to 5 jobs in horror.

In this blog I want to share my cryptocurrency indexing strategy, give my opinion on cryptocurrency and talk at a very high level on the benefits it can bring to the financial world, as I see it.

This is from a very simplistic perspective. It's not a deep dive on the technology. I look at cryptocurrency from a philosophic point of view in how money itself is structured and has been structured from sea shells thousands of years ago to promissory paper (now).

I will cover how I index a small basket of Cryptocurrencies, how I HODL a portfolio that has returned over 800% in the last 12 months. Also, I will cover some new financial products available to the masses, the more "risk averse" can add to their own portfolios using more traditional means (like banks, ironically).

Just like people thought e-mail and the internet would be used by a few, I think many boomers have got it wrong on what Crypto is and will be:

Cryptocurrency has many mainstream critics who simply have no idea what they are talking about or worse, recognize that Cryptocurrency could mean the end for banking as we know it. It makes sense that Warren Buffet and others would dismiss cryptocurrency, namely because it would destroy old institutions of power!

Why I Like Crypto and What Potential do I see

Picture this. The government decides they want to spend your tax money (and or print money without your consent and devalue their currency). They will decide where the money goes and you, the peasant that you are, will not need to know where the money ends up - kind of like what happens now!

The current financial paradigm is central bank driven is the primary cause of boom and bust cycles which are inherently baked into it's structure. Fore more depth on this, feel free to visit Mises Institute and read up on the basic premise of Austrian economics.

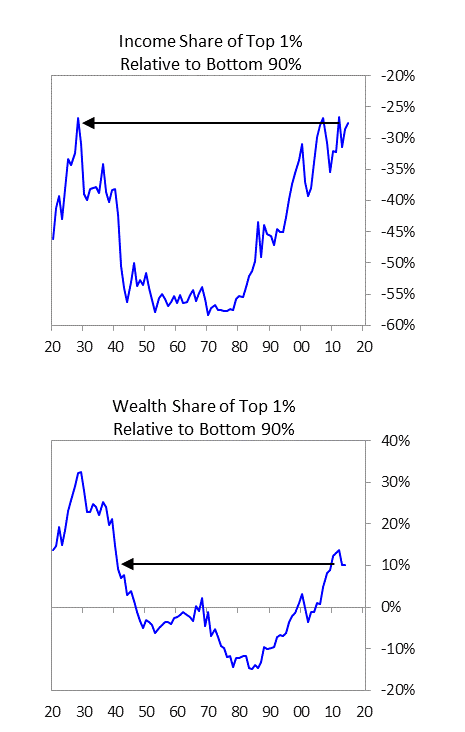

The current financial plumbing is beginning to leak, to plug the whole, central banks are pumping paper money into the system in the hopes that it will promote growth, increase spending and we all live happily ever after. If you can't see a problem with this, then think about your own buying power in terms of assets in the last 10 years.

Plan B for a Failing Keynesian System

With fiat currency, a central authority, let's call it "big brother" for argument sake, tells you how much your money is worth, can cut it off, switch it on, tax it and all the while line their own pockets and that of the people who perpetuate the system.This drives wealth inequality up and keeps those in power (who control money supply)... in power. As put by Yanis Varoufakis "The Weak Suffer What they Must"

If you won't take my world for it, Ray Dalio (who manages the biggest hedge fund in the world), also thinks so:

A central planning committee (non-elected) determines the rules of wealth distribution and the tax payer sees government not as a service but as a necessity. Who gets the money? Where does it go? Why does my tax go here? It's insane if you really think about it, the state itself creates the law we have a "Rules for thee and not for me" reality.

If you want an introduction to this absurdity, I highly recommend reading "The Anatomy of the State" by Murray N. Rothbard or "The Law" by Bastiat. Seminal work on the absurdity of state control of everything.

The risk of corruption is high, trust and transparency is low and if they make some dumb decisions, not that governments do (wink fucking wink), then "whoopsie" 1929, 1987, dotcom crash, 2008, you name it.

Other obvious examples which I've mentioned in my post on inflation are to do with government controlling or having authority over:

- Your bank account. They can switch it on, switch it off and do whatever they want

- Your data, where you go and what you spend your money on

- Inflating the currency supply without a vote. Seldom do people want to bail out banks, however, in this version of "democracy", we don't vote on it. So they decide what do do with your money and tax you for the privilege.

The plumbing of these institutions is very ironic too. They claim to respect the law but are always caught laundering money for cartels and warlords (Reuters Article Here) whilst claiming cryptocurrency (which is on a public ledger), is murky. It's almost like... I don't know, they want to retain their monopoly on money supply, influence and control. Go figure.

Cryptocurrency flips many of these murky and dogmatic approached to finance on their back and as I see it, provides a true technologically sound alternative to centralized planning and pseudo-communist governmental control.

How Cryptocurrency Democratizes Finance

The Utopian (or romanticist) view of cryptocurrency is for a far more meritocratic approach to finance.

Essentially you and a vast network of people you don't know, agree a price on a fully transparent decentralized and public currency which is:

- Trust-less (the trust is embedded in code and the rules are on display)

- Fully transparent

- Not governed with an on/off switch by any individual

- Takes seconds to transact almost for free, you can also provide liquidity

- Has a clear set of rules to govern supply and demand which can be voted on

- Is impossible to dispute and or hack depending on the architecture

- Enables legacy business to transact online and participate

- Allows people to vote on it's use

- Democratizes decisions

- Retains buying power

- Need I go on?

Cryptocurrency if adopted and used correctly is basically like democratizing a central bank, a central bank that everyone can participate in and vote on! Perhaps we should call it a de-central bank. Instead of basing the assumptions on dogmatic notions of finance, it is based on the best technology and system whereby people decide to use multiple currencies for different mediums.

A fantastic read on this by Hayek "The Denationalization of Money" put forward such arguments decades ago.

Instead of Wallstreet, huge business interests and governments determining all the rules, people and specific groups of people can agree on how "money" is distributed, whether or not there is a set supply or the supply increases by automated rules. Just as in any competitive business, the most competitive and compelling idea wins out. Essentially, the evolution of money.

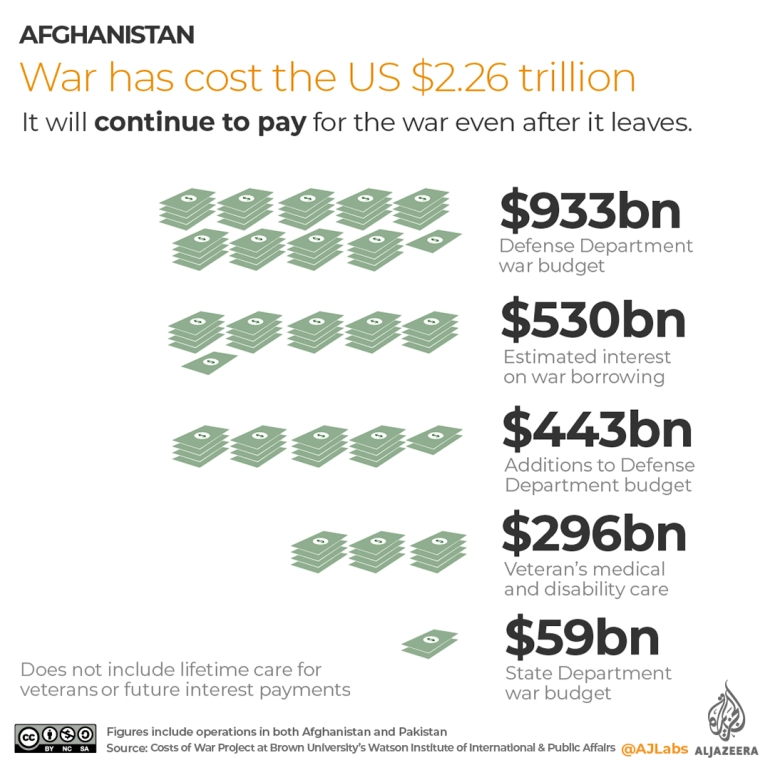

It is free markets in motion as people agree on a value of something, can easily exchange it and is all stored on a network that is hard to hack and very hard to dispute. If we go really deep into this, you could avoid financing pointless wars and spending trillions of tax payer money to arm foreign nations.

Without the power to print and inflate money, the central powers that be have far less influence over people's lives. By voting with your digital feet, you can put your assets to use alongside your own values as opposed to being coerced into spending for "the greater good".

Now the Disruptive Part

Cryptocurrency has the potential to fully automate the financial system with a series of checks, balances and smart contracts.

Cryptocurrency does not require:

- Hundreds of thousands of lawyers to dispute or resolve issues

- Trillions of dollars of bureaucracy layers which creates huge inefficiency (inflating jobs numbers)

- Days or weeks of delays to settle transactions

- Millions of trees worth of paper to log things and file them off (physically)

- Massive transport networks to lock, secure and transport physical cash and or currency

- Physical building networks and millions of employees doing mundane

- Huge legacy infrastructure which is impossible to change

- People snooping into your financial affairs

The list goes on and on. The ability to automate the economy, drive huge efficiencies into the system, loan money, take credit and see it all with full transparency - no wonder the banks are shitting themselves.

If It's So Great Then Why Not go All in?

So with all of these huge benefits and exponential scalability, why not put all your chips on the table?

I think the last paragraph explains it all. Even though functionally it can't be regulated (because it's decentralized). There are many institutions and governments who are trying to regulate, plug holes or reign cryptocurrency in under their big old dogmatic umbrella. Think Catholic church or dying Roman empire!

Cryptocurrency is essentially a systematic risk to all of these old powers and thinking they will let go is just whimsical. Governments and banks have a few options at their disposal such as:

- Creating fear and uncertainty which increases market volatility scaring away new money.

- Governments will try and regulate, tax or make owning cryptocurrency outright illegal (good luck with that!) The war on drugs really stopped drugs right.... just did the prohibition of alcohol.

- Large institutions can corner markets and easily manipulate the price or control the narrative or smaller cryptocurrency, think Elon Musk and Bitcoin.

- Governments could simply bring out their own cryptocurrencies.

- Increased surveillance into personal transactions like the social credit system in China.

With these factors, even though my long term hypotheses would be bullish, it is useful to be on the side of government. Good to still make sure the tax man is your buddy and not isolate yourself, at least not legally.

The Newsletter

Sign up to get a monthly email about my trading journey, what I learnt or failed to learn and receive exclusive access to unpublished material and resources.

So How do I Invest in Cryptocurrency?

I use a few methods to hold cryptocurrency, as a general rule of thumb I like to hold around 5-10% of total net worth in Crypto, this is not a recommendation but my style. I will never be an "all-in" kind of guy. Although I trade and stake crypto, I believe indexing offers the average retail investor a unique opportunity to gain exposure to cryptocurrency without the need for a tin foil hat.

Indexing

To start off with, I keep some cryptocurrency on exchanges, I use a few different exchanges just in case there is another Mt. Gox event and basically buy and balance a basket of cryptocurrencies. My personal preferences are Binance, FTX & Swissborg.

If you are not familiar with stock indexing or asset indexing it is pretty simple:

- In principle indexing means owning multiple assets vs having all your eggs in one basket so you can have exposure to the "market" vs an individual asset.

- By re-balancing these assets with specific time frames you put out sized gains back into poorer performing assets to smooth your equity curve and balance the expected distribution of returns.

Example: If you purchased Lehman Brothers before 2008 but held it through the crash, you would have $0. If you owned the top 50 Banks you would be up almost 100%.

There are a Few Ways to Index

You can get indexing exposure to cryptocurrency in a few ways:

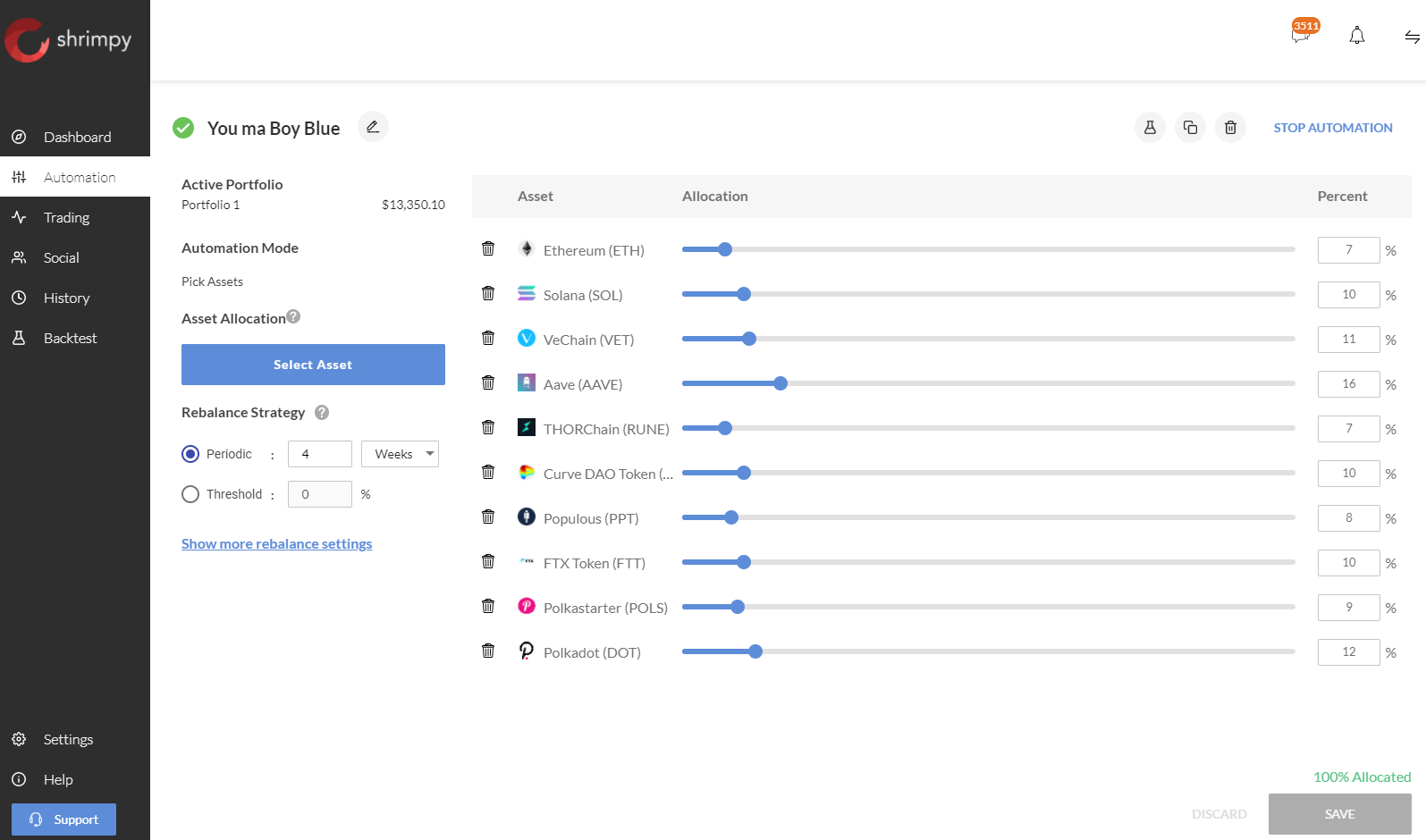

You can use an app or an API which connects to a cryptocurrency exchange. This is my own preferred method as I can pick and choose the cryptocurrencies I want and then simply set my own re-balance rules. Personally, I use Shrimpy to do this. Full tutorial on what's involved here.

I select a basket of Cryptocurrencies that I like in terms of fundamentals, liquidity and technology, I then re-balance them every four weeks. I also have a few different indexes running and can choose highly speculative assets and altcoins or create a thematic personal ETF weighted towards DEFI projects.

Indexing is great because if you have long term projects spiking to high profits while others lag, over time, it will disperse the winning across all the assets to give you more odds of being in a few good projects, avoiding FOMO and still capturing some nice trends.

In relation to total cryptocurrency allocation. 50% is indexed and I trade the rest or stake it using cold storage.

The flexibility in using something like Shrimpy is multi-faceted:

- If you like specific projects you can weight as you like.

- You can back test your hypothesis using their software - really cool feature!

- You can create your own themes and outperform the classic or prescribed indexes.

Of course, if you don't like the thought of managing, understanding and risking the DIY approach, which is not for everyone - you can also turn to ETN's or ETP's (legal ways of owning cryptocurrency via the stock market). Recently, there are some good indexed products available which hold a very smartly weighted basket of cryptocurrency which can be managed by a company on your behalf. Some examples you can look up:

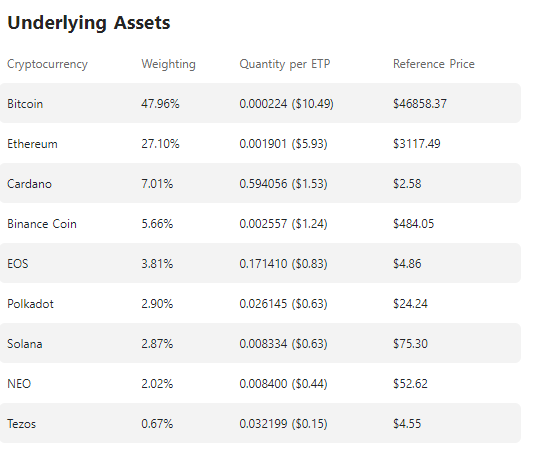

Sygnum "Moon" ETP which holds the below allocations:

You can also buy Bitcoin replication products and other indexes all listed on stock exchanges:

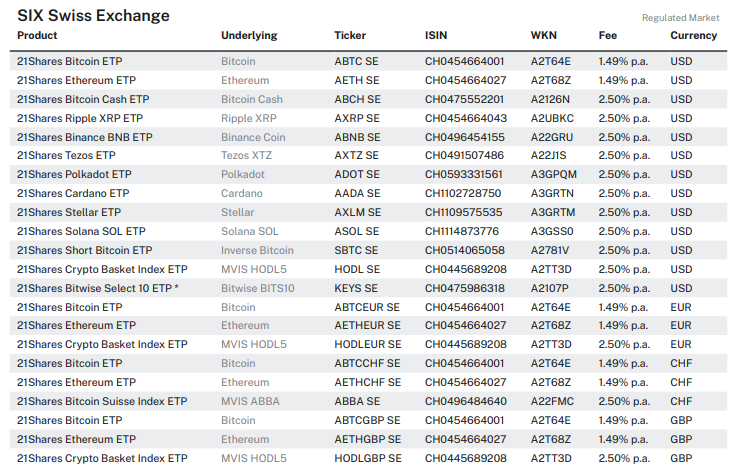

From what I have researched in the industry. The Titans of the cryptocurrency ETN world are 21 Shares (Swiss based) and Grayscale which is also making big moves in this space. There are of course other proxies like the company Coinbase but the time series is not sufficient to prove it's correlation.

ETN's and ETF's are very practical for the older generation who want the exposure without the technical know how that could be involved with setting up your own basket of cryptocurrency. It also has additional benefits for less technically savvy:

- The security risk is managed be a professional firm (make sure of that yourself)

- The assets are easily visible and tax reporting is straight forward

The limitations of owning cryptocurrency through a third party are like any other form of third party ownership:

- If you hand your money to a fund that falls into disrepute, your money and crypto goes with them.

- If you prefer the true nature of crypto and decentralized governance, giving your power to others in this sense defeats the purpose of cryptocurrency.

- If there is an adverse price reaction on the weekend, you have no way of selling or avoiding a crypto crash.

- They typically charge higher than average fees.

Get Started in Cryptocurrency

To get started in cryptocurrency I highly recommend taking an indeed approach if you do pursue this path. Of course, before investing in any asset, it makes sense to form your own opinion on why this may or may not be the asset class for you.

Personally, I think the biggest risk of all is having money in cash. I like to spread my bets into all asset classes and have a strong but also speculative approach to asset appreciation!

Get in touch, drop a comment or join our telegram channel. Hoping you found this useful!