I found it ironic that when I opened up the draft of this blog post and it was dated almost 9 months ago. A testament to just how insidious procrastination can be. Nevertheless, I suppose it's good to be real about it.

The thing is, both in trading and in life, it's mostly the things we don't do that cost us money. The hard things, usually tedious and time consuming ones we conveniently forget (ahem... trading journal).

Pulling the trigger and buying a stock has become far too easy and we seek the quick dopamine hit vs following our plan. The "Insta" generation is a powerful force after all and not realizing this can be toxic for you and your portfolio.

Let me categorize these and see if it resonates on what's easy:

- Buying shares

- Selling shares

- Buying too many shares

- Quickly selling them

- Realizing you are doing the above and get frustrated

- Shooting from the hip from Twitter trades

- Trading on people's tips

- Conveniently leaving trades on without stop losses

- Buying too high

When I look at my major trading mistakes and the most common mistakes in trading from associates, they typically involve these knee-jerk buy and sells. Overtrading, buying others opinions and not flowing with the market. "I am clearly not smart, therefore let me outsource my accountability to Twitter". Its clear that this is down to a lack of confidence and knowledge. Usually, because people are procrastinating on the deep work required to analyse stocks and learn from mistake.

The flip side is the stuff we should do but don't - the stuff we procrastinate on:

- Going through charts and coming up with a plan

- Position Sizing based on a strategy that you have tested

- Meditating before market open or other methods of reflection

- Logging trading journals and being meticulous on the detail

- Reviewing trades in-depth and play by play and refining or defining an edge

- Forming our own ideas and maintaining them

- Avoiding over-exposure to social media

One fundamental question I've had to reflect on recently and something that helps me do the hard work is a statement I heard during a trading workshop with Mark Minervini:

"How would this Trade look on your spreadsheet... if you could only take 10 trades per year, would this be one of them?".

I'll be honest, I delay doing my spreadsheet sometimes because I know it will look and feel shit. It's funny how looking away is easy. The perception that loss is bad creates the loss in itself, we focus on loss and it comes. "Thoughts are things".

The real power comes when we look hard at these results and seem them differently. I have adopted a mindful approach to self-coaching and frame it as a learning opportunity. Good book on mindful

The Newsletter

Sign up to get a monthly email about my trading journey, what I learnt or failed to learn and receive exclusive access to unpublished material and resources.

Change is Habitual but be Gentle

The thing is, to remove procrastination and the self-judgement that comes with it, there are a few cures. The most lasting and useful one is recognizing these patterns and giving them a label, developing self-awareness and re-framing the habit to work for you. Mistakes need to become looked at regularly with an attitude of learning instead of defeat or depression.

That feeling of procrastination is just a chemical signal. Instead of feeling guilt, why not feel empowered to act because you know it's where the money is. And we are here to make money!

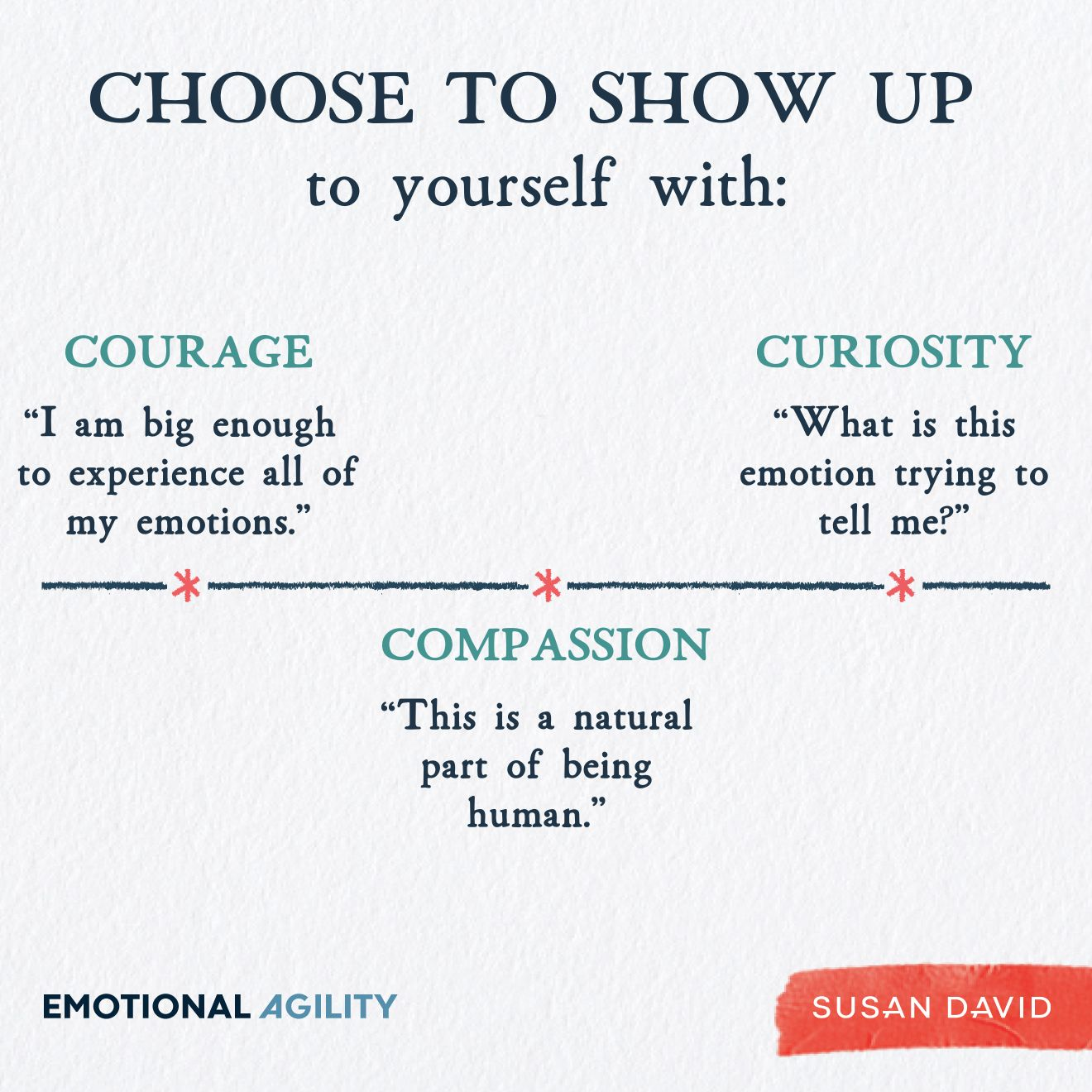

Nothing scares me more than knowing something and acting against it or outright ignoring it. The subconscious is in control and we are asleep at the wheel if we decide to look away and avoid temporary discomfort. It's good to "show up" and look at the reasons we procrastinate (with courage, curiosity and compassion).

For much more detail on the psychology behind this and some good mehtonds on how to tackle it, I suggest reading "Emotional Agility" by Susan David, it really drills into the science on this:

This is the opposite of the flow state I have when I am winning. And I win when I follow my plan. That connected time I have when on a hot streak is amazing. It's natural and effortless and I am doing the work. Easier of course when winning. The hard times however are when the real work starts and the amateurs typically leave the room.

Emotions are Just Signals

As a trader, listening to our emotions and noticing emotional safety signals that perpetuate procrastination - and changing them, could very well be the trading edge that so many people need but can't find. They are too busy looking outside of themselves for the answer. Mostly because of social comparison and self-perpetuating delusions of wealth or a shitty upbringing without challenge.

The real "magic system" has you at its core. Creating a clear plan, testing it and knowing when to bend with the market. The only way to do this is to... well... do the hard things which are tedious and a pain in the ass (journals, trade reviews, looking at failed trades, back-testing).

When the emotions and fears which cause procrastination begin flooding your mind and putting you in zombie mode, it's the habits and conscious awareness that bring us back to life in order to fire up the high potential trader in all of us.

I've found James Clear's Atomic Habits and Susan David's book (mentioned earlier) to be instrumental in labeling these issues, creating new habits and focusing on the process - not the delusions of grandeur. I now measure these signals on a daily basis and focus on the process first, not the outcome.

Short and Sweet

I want to keep my message very short and sweet. No bullshit, just the reality of trading. Ask yourself these questions, decide for yourself what makes sense:

- Am I avoiding reviews because it hurts to much to see the truth

- What do I think the truth means to me? Will I see losses as bad or good?

- What is preventing me from journaling my trades? Guilt?

- Is the guilt and reality of trading something I have the power to change?

- If I have the power to change it, what can I do to improve?

If you take a long hard look in the mirror. Are you really doing what you know to be true but are just ignoring the reality and procrastinating? If this is the case, you only have one thing to do! Be honest and kind to yourself!

The only way to defeat procrastination and build your plan is to face the fear head on. Once you see the reality of your own potential as a human (with an infinitesimally small probability of existence), it can be easy to recognize just how much better you could do, if you were awake. It's time to wake up.

My challenge to everyone reading this and to myself. Do you truly think you can make it in trading, or anything else for that matter? Is procrastinating slowly killing your dreams with Netflix series and porn pulling at you when behind a screen. If so, as Nike would say (sort of), it's time to "just fucking do it".

Hoping this hits home. This came from a great session with my psychologist. Wanted to share it with you all! Pull out that journal and prove me wrong.