I think we can all agree, the last 18+ or so months has been tough. Most traders, friends and colleagues have watched their portfolios nosedive and are asking, "when will the bleeding stop".

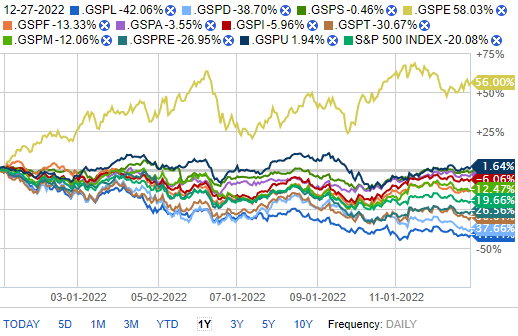

Nothing seems safe, well, perhaps the energy sector; chart below (lifted from Fidelity's website), but at the time of writing even energy has nosdived due to the future discounting of growth around the globe.

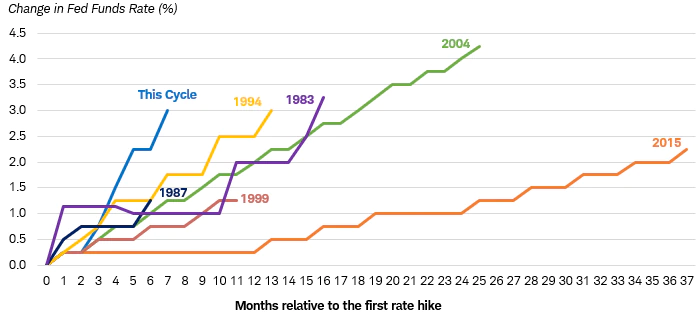

Everyone is hoping for a magical "Fed pivot" to go back to the glory days of easy money when the central banks were printing us into oblivion. With interest rates rising, money has value again. So the macro outlook has fundamentally changed:

- With money having value again, why hold a 1.5% dividend stock when I can get 6% from a bank directly with no downside risk?

- The rise of 10 year treasuries just hit a 16 year high. (https://www.ft.com/content/1b6e5631-ae66-462a-a6db-a44174ed76ac)

- If lending has become expensive, what does that mean for companies with too much debt? (Expensive debt = lower earnings per share).

- With higher interest rates, what impact does that have on mortgage holders? Hint (higher mortgage costs, less disposable income, less disposable income = less amazon orders).

- With less disposable income which sectors will get hit the hardest?

It doesn't take much to understand the consequences here. Expensive money means less earnings, so high flying tech stocks get nailed that bit harder. The silver lining being, money has rotated back into the real economy (for now) so materials, commodities and things of "real" value have been rewarded. However, that also has a finite lifespan.

Crypto was essentially the canary in the coal mine. I anticpate far more pain in highly speculative areas before they turn on the taps again.

Below, I've charted the 30 Year Mortgage rate in the US vs the Nasdaq for a "Growth Stock" proxy:

It's easy to visualize the impact of mortgage interest rates on the overall health of the market, some other interesting charts that indicate near term doom:

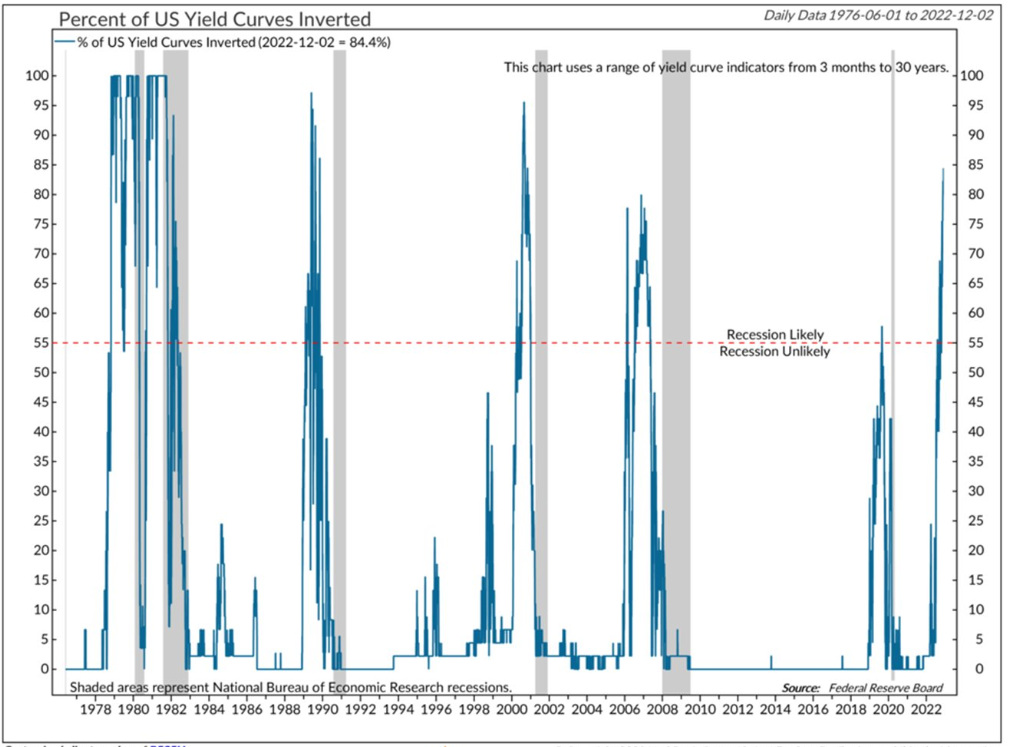

From Ned Davis Research (extracted from Mark Minervini's Twitter Account):

- Around 84% of the US yield curves are inverted

- Historically when compared to the grey areas this precedes recessions

- For more information on yield curve inversion check out this useful resource on Investopedia

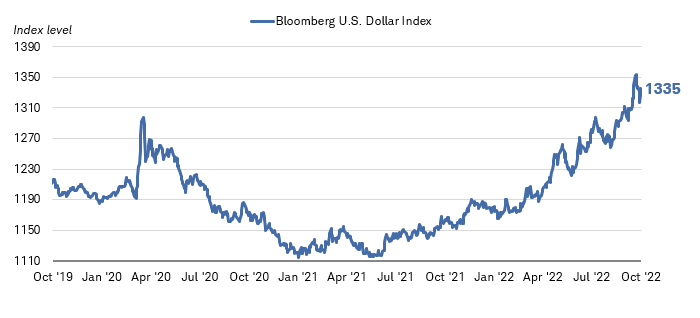

Strong dollar, although it has weakened somewhat since this post.

Other Bearish Markers

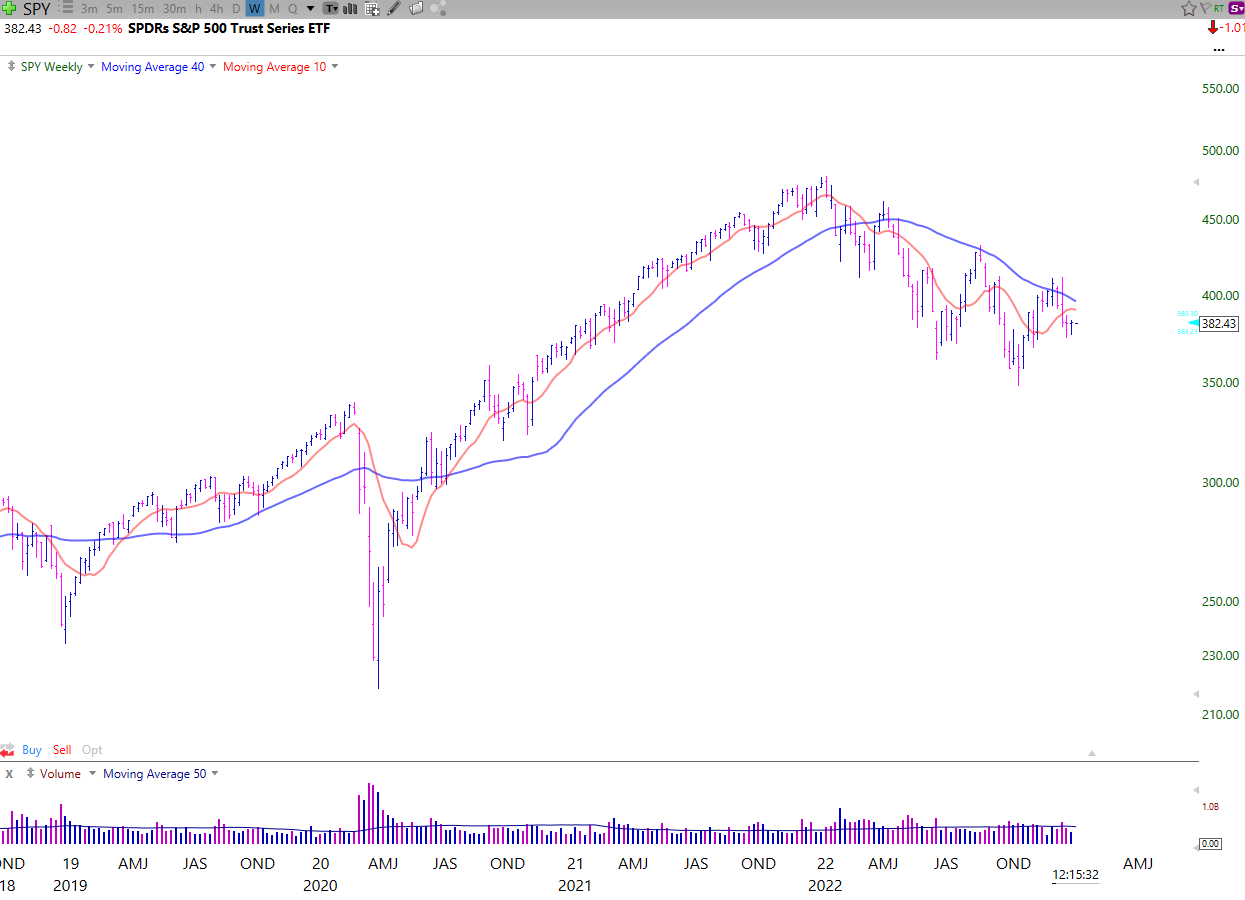

Some other incredibly simple things to look at are the major indexes which are trading below key long term moving averages:

Major indexes are all trading under their key moving averages which indicates further declines or at least friction to the upside.

Most, if not all traders following this blog should have been out of the market months ago if they followed the simple sell rules I use to avoid getting whacked in the market. A reminder of this blog can be found here "Avoid stock market crashes using these simple rules".

It's Time to Observe

Now that most people are losing intrest in the market, opportunities start forming as new and emerging stocks begin to base out and form good setups. This is the absolute best time to screen, create watch-lists and keep your eye on the charts.

Bear markets may seem unbearable (pun intended) but it's imperative to keep your eye on the prize (chart lifed from https://centerpointsecurities.com/bear-markets/).

Preparing for the Next Bull Market

It's important to keep an eye for a few major catalysts and indicators to identify when to get aggressive again, this is my own list but you get the picture:

- Better than expected CPI (Lower CPI is better) - if the FED approaches it's inflation target of 2% they could pause interest rate rises

- Lower energy costs (low energy, cheaper costs)

- Individual stocks acting well and forming new pockets of strength.

- Follow through days on the major indexes.

Right now, people are giving up on stocks, crypto and trading in general. If you use simple game theory, that lack of discipline and resilience is where people lose the most. There is always money on the sidelines, in fact, money has pumped into money market funds at an astounding rate, reference below.

It's incredibly important to see what stocks are acting strong, not selling off on fear and building smooth, volatility free patterns that are prime for breakouts. If prior bear markets give a historical precedent, we aren't that far from a new set of winnign stocks that are slowly churning through various supply and demand patterns.

Keep your eye out, build your list, don't get too aggressive too soon and wait fot the stocks to come to you. When the masses are complacent, the open to works start spiking on LinkedIn and things seem unbearable, the central banks will have to decide what happens next. For those who can trade shorter time frames, hedge positions and keep their nose clean, this is a fantastic opportunity to raise cash and prepare for the next big thing.

The Newsletter

Sign up to get a monthly email about my trading journey, what I learnt or failed to learn and receive exclusive access to unpublished material and resources.